Despite an already strong run, Vince Holding Corp. (NYSE:VNCE) shares have been powering on, with a gain of 53% in the last thirty days. The last 30 days bring the annual gain to a very sharp 28%.

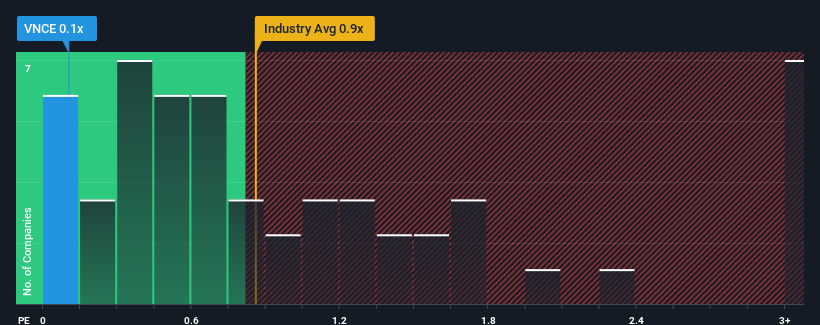

Although its price has surged higher, considering around half the companies operating in the United States' Luxury industry have price-to-sales ratios (or "P/S") above 0.9x, you may still consider Vince Holding as an solid investment opportunity with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Vince Holding Performed Recently?

While the industry has experienced revenue growth lately, Vince Holding's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vince Holding.How Is Vince Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Vince Holding's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Vince Holding's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 4.2% during the coming year according to the two analysts following the company. That's shaping up to be similar to the 3.1% growth forecast for the broader industry.

With this information, we find it odd that Vince Holding is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Vince Holding's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Vince Holding's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 5 warning signs for Vince Holding (2 are concerning!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.