In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term Lions Gate Entertainment Corp. (NYSE:LGF.A) shareholders, since the share price is down 42% in the last three years, falling well short of the market return of around 20%.

On a more encouraging note the company has added US$79m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Lions Gate Entertainment wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Lions Gate Entertainment saw its revenue grow by 5.8% per year, compound. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 13% over the last three years. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

In the last three years, Lions Gate Entertainment saw its revenue grow by 5.8% per year, compound. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 13% over the last three years. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

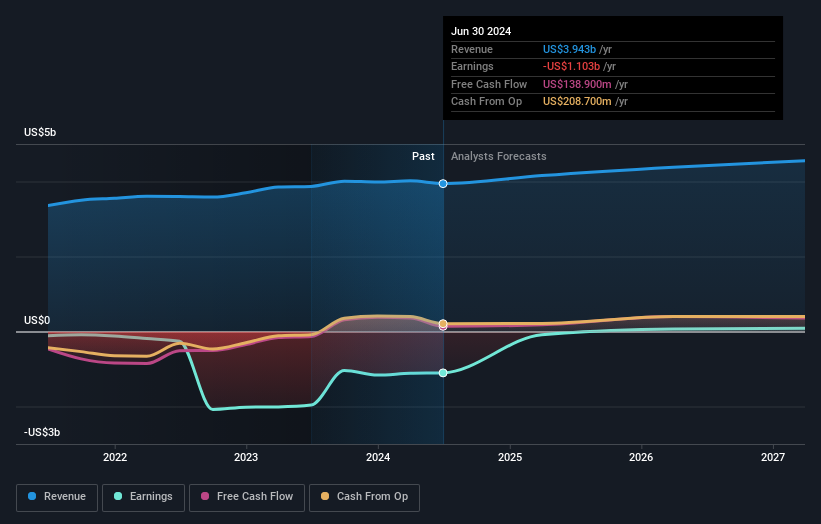

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Lions Gate Entertainment will earn in the future (free profit forecasts).

A Different Perspective

Lions Gate Entertainment shareholders are down 9.2% for the year, but the market itself is up 30%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Lions Gate Entertainment better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Lions Gate Entertainment .

Lions Gate Entertainment is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.