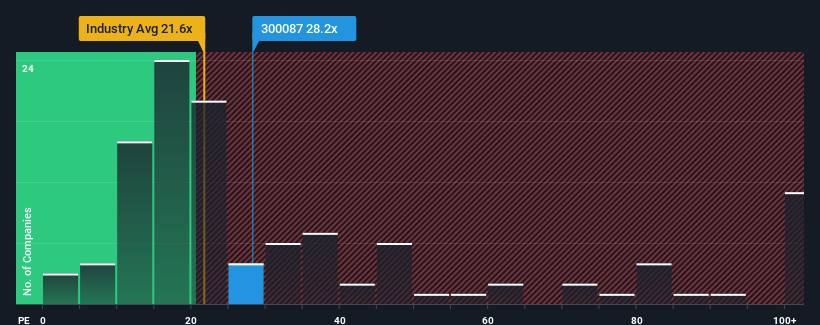

There wouldn't be many who think Winall Hi-tech Seed Co., Ltd.'s (SZSE:300087) price-to-earnings (or "P/E") ratio of 28.2x is worth a mention when the median P/E in China is similar at about 26x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times haven't been advantageous for Winall Hi-tech Seed as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

How Is Winall Hi-tech Seed's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Winall Hi-tech Seed's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. Even so, admirably EPS has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. Even so, admirably EPS has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 37% per annum over the next three years. With the market only predicted to deliver 19% per year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Winall Hi-tech Seed's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Winall Hi-tech Seed's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Winall Hi-tech Seed you should be aware of, and 1 of them can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.