Financial giants have made a conspicuous bullish move on Roblox. Our analysis of options history for Roblox (NYSE:RBLX) revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $223,798, and 4 were calls, valued at $213,274.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $40.0 and $50.0 for Roblox, spanning the last three months.

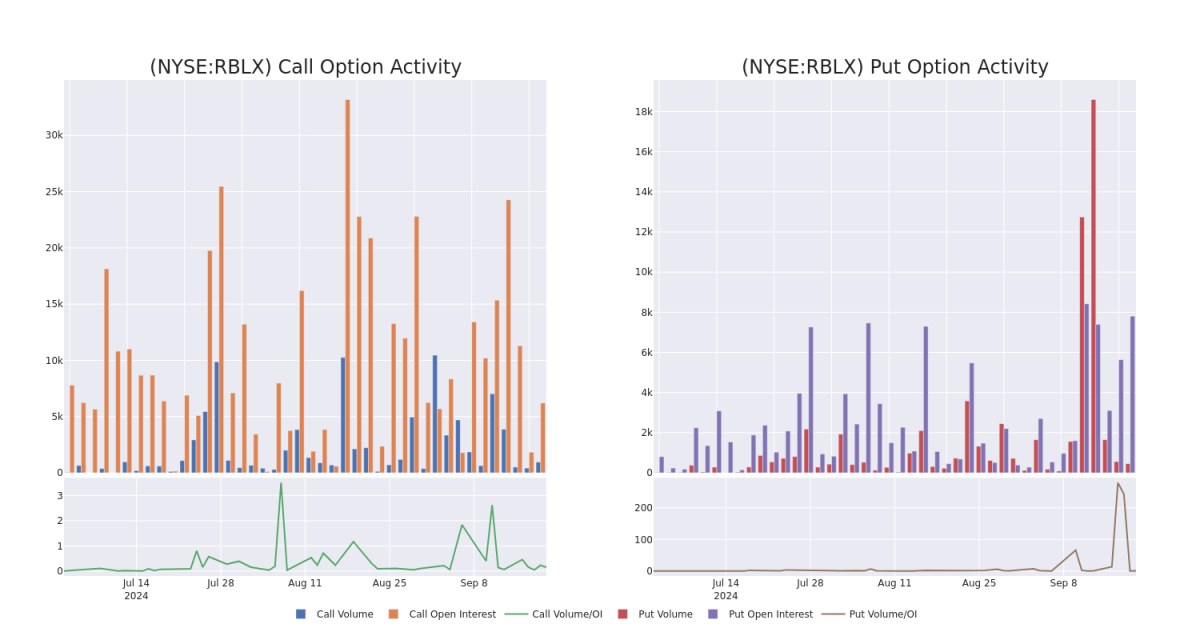

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Roblox's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Roblox's significant trades, within a strike price range of $40.0 to $50.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Roblox's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Roblox's significant trades, within a strike price range of $40.0 to $50.0, over the past month.

Roblox Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | PUT | SWEEP | BULLISH | 06/20/25 | $8.35 | $7.6 | $7.6 | $47.50 | $80.5K | 225 | 106 |

| RBLX | CALL | TRADE | BULLISH | 06/20/25 | $7.5 | $7.45 | $7.5 | $47.50 | $71.2K | 746 | 190 |

| RBLX | CALL | TRADE | BULLISH | 06/20/25 | $7.45 | $7.3 | $7.45 | $47.50 | $70.7K | 746 | 95 |

| RBLX | PUT | SWEEP | BEARISH | 11/15/24 | $3.35 | $3.35 | $3.35 | $45.00 | $61.3K | 4.9K | 9 |

| RBLX | PUT | SWEEP | BULLISH | 11/15/24 | $1.6 | $1.59 | $1.59 | $40.00 | $48.8K | 1.9K | 318 |

About Roblox

Roblox operates an online video game platform that lets young gamers create, develop, and monetize games (or "experiences") for other players. The firm effectively offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning revenue in multiple places while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers then creating new games or franchises.

In light of the recent options history for Roblox, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Roblox

- Currently trading with a volume of 2,869,481, the RBLX's price is down by -1.25%, now at $45.72.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 47 days.

What Analysts Are Saying About Roblox

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $51.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from BTIG persists with their Buy rating on Roblox, maintaining a target price of $51.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Roblox options trades with real-time alerts from Benzinga Pro.