It's understandable if you feel frustrated when a stock you own sees a lower share price. But often it is not a reflection of the fundamental business performance. So while the Chengdu Fusen Noble-House Industrial Co.,Ltd. (SZSE:002818) share price is down 20% in the last year, the total return to shareholders (which includes dividends) was -13%. That's better than the market which declined 17% over the last year. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 14% in three years.

On a more encouraging note the company has added CN¥367m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Chengdu Fusen Noble-House IndustrialLtd share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

Even though the Chengdu Fusen Noble-House IndustrialLtd share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But looking to other metrics might better explain the share price change.

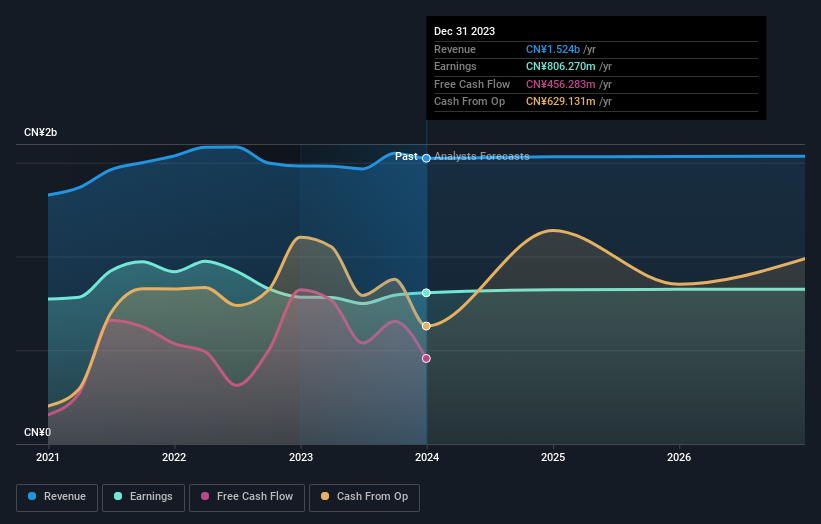

We don't see any weakness in the Chengdu Fusen Noble-House IndustrialLtd's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Unless, of course, the market was expecting a revenue uptick.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Chengdu Fusen Noble-House IndustrialLtd's TSR for the last 1 year was -13%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Although it hurts that Chengdu Fusen Noble-House IndustrialLtd returned a loss of 13% in the last twelve months, the broader market was actually worse, returning a loss of 17%. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Chengdu Fusen Noble-House IndustrialLtd better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Chengdu Fusen Noble-House IndustrialLtd you should be aware of.

Of course Chengdu Fusen Noble-House IndustrialLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.