Why Hidden Debt Matters

Investors often focus on basic financial figures, but it's essential to consider hidden debt when evaluating a company's true worth.

Insights from Viridian Capital Advisors reveal that overlooked liabilities can significantly change how we view a company's value, making it crucial to dig deeper.

- Get Benzinga's exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can't afford to miss out if you're serious about the business.

Viridian's Approach To Valuation

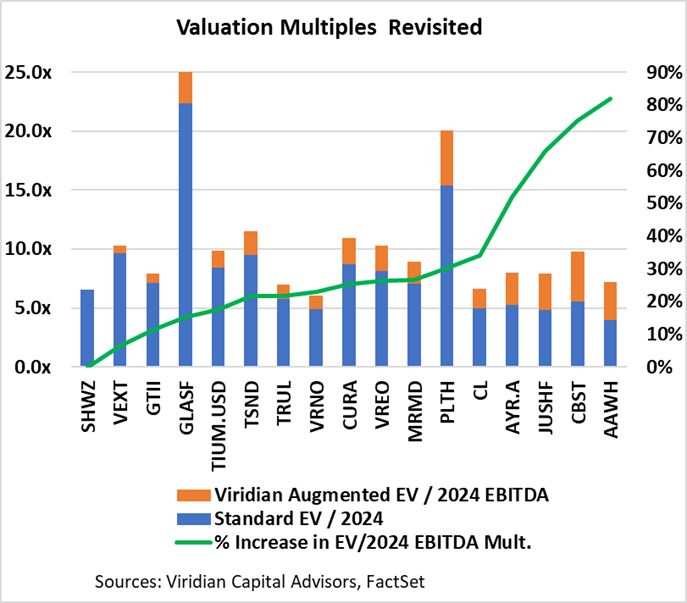

Typically, enterprise value (EV) is calculated using standard methods. However, Viridian takes a more thorough approach by including lease obligations and overdue tax payments.

They also consider long-term tax liabilities that companies have yet to address. This results in a higher debt figure and leads to revised calculations that show companies may be more valuable than initially thought.

They also consider long-term tax liabilities that companies have yet to address. This results in a higher debt figure and leads to revised calculations that show companies may be more valuable than initially thought.

The Impact On Investor Decisions

A recent graph compares traditional valuation methods with Viridian's updated figures. Companies that appeared cheap may be less undervalued than previously believed, particularly those burdened by significant lease or tax liabilities.

Market Perception of Undervalued Cannabis Stocks

Companies like Planet 13 Holdings (OTC:PLNH) and MariMed (OTC:MRMD), which initially appeared undervalued based on traditional EV/EBITDA multiples, saw significant valuation increases when Viridian Capital's augmented EV calculations factored in hidden debt. This reveals that investors who overlook these liabilities might mistakenly view these companies as more attractive investments than they truly are.

Impact of Debt on Investor Sentiment

In contrast, companies such as Schwazze (OTC:SHWZ), Vext Science (OTC:VEXTF), and Green Thumb Industries (OTC:GTII) show minimal changes in valuation, suggesting cleaner balance sheets that could strengthen investor confidence.