The XJ International Holdings Co., Ltd. (HKG:1765) share price has fared very poorly over the last month, falling by a substantial 32%. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

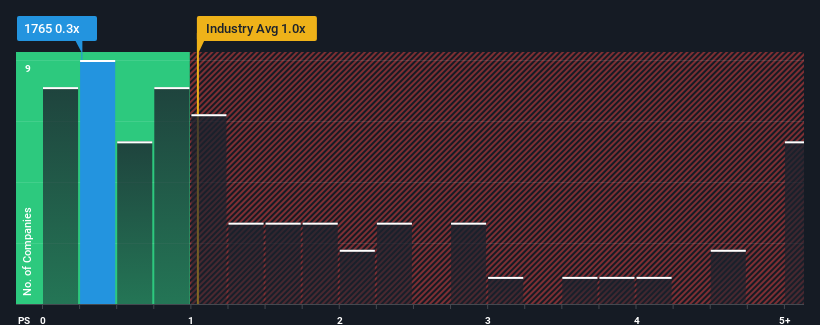

Although its price has dipped substantially, given about half the companies operating in Hong Kong's Consumer Services industry have price-to-sales ratios (or "P/S") above 1x, you may still consider XJ International Holdings as an attractive investment with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has XJ International Holdings Performed Recently?

Revenue has risen at a steady rate over the last year for XJ International Holdings, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on XJ International Holdings' earnings, revenue and cash flow.How Is XJ International Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, XJ International Holdings would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, XJ International Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 6.9% gain to the company's revenues. Pleasingly, revenue has also lifted 128% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 19% shows it's noticeably more attractive.

In light of this, it's peculiar that XJ International Holdings' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From XJ International Holdings' P/S?

XJ International Holdings' recently weak share price has pulled its P/S back below other Consumer Services companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see XJ International Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for XJ International Holdings (of which 2 are a bit concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.