If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. So after we looked into Zhongyu Energy Holdings (HKG:3633), the trends above didn't look too great.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Zhongyu Energy Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.057 = HK$846m ÷ (HK$26b - HK$11b) (Based on the trailing twelve months to June 2024).

0.057 = HK$846m ÷ (HK$26b - HK$11b) (Based on the trailing twelve months to June 2024).

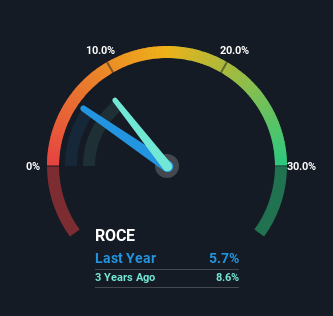

So, Zhongyu Energy Holdings has an ROCE of 5.7%. In absolute terms, that's a low return and it also under-performs the Gas Utilities industry average of 8.2%.

Historical performance is a great place to start when researching a stock so above you can see the gauge for Zhongyu Energy Holdings' ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Zhongyu Energy Holdings.

The Trend Of ROCE

In terms of Zhongyu Energy Holdings' historical ROCE movements, the trend doesn't inspire confidence. About five years ago, returns on capital were 11%, however they're now substantially lower than that as we saw above. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Zhongyu Energy Holdings to turn into a multi-bagger.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 44%, which has impacted the ROCE. Without this increase, it's likely that ROCE would be even lower than 5.7%. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

What We Can Learn From Zhongyu Energy Holdings' ROCE

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Investors haven't taken kindly to these developments, since the stock has declined 32% from where it was five years ago. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

Like most companies, Zhongyu Energy Holdings does come with some risks, and we've found 2 warning signs that you should be aware of.

While Zhongyu Energy Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.