Shenzhen Fortune Trend technology Co., Ltd. (SHSE:688318) shareholders have had their patience rewarded with a 34% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 8.0% isn't as impressive.

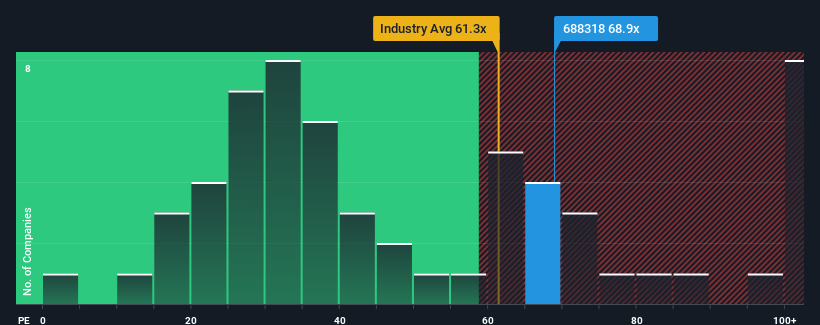

Since its price has surged higher, Shenzhen Fortune Trend technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 68.9x, since almost half of all companies in China have P/E ratios under 27x and even P/E's lower than 16x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Shenzhen Fortune Trend technology as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Is There Enough Growth For Shenzhen Fortune Trend technology?

The only time you'd be truly comfortable seeing a P/E as steep as Shenzhen Fortune Trend technology's is when the company's growth is on track to outshine the market decidedly.

The only time you'd be truly comfortable seeing a P/E as steep as Shenzhen Fortune Trend technology's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 66%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 48% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 36% growth forecast for the broader market.

With this information, we can see why Shenzhen Fortune Trend technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shenzhen Fortune Trend technology's P/E

The strong share price surge has got Shenzhen Fortune Trend technology's P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shenzhen Fortune Trend technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Shenzhen Fortune Trend technology has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than Shenzhen Fortune Trend technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.