Zhuhai Huafa Properties Co.,Ltd (SHSE:600325) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

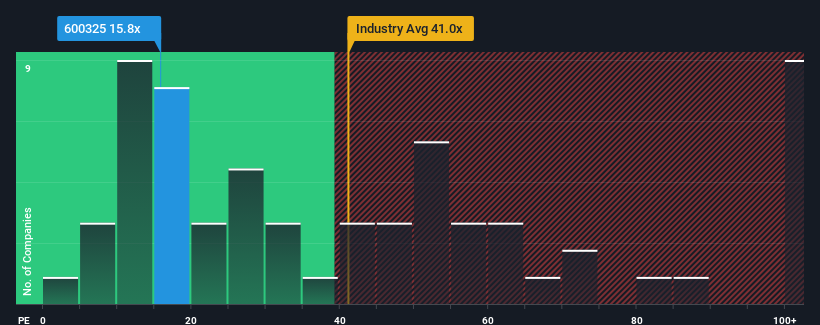

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 29x, you may still consider Zhuhai Huafa PropertiesLtd as an attractive investment with its 15.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Zhuhai Huafa PropertiesLtd has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Is There Any Growth For Zhuhai Huafa PropertiesLtd?

The only time you'd be truly comfortable seeing a P/E as low as Zhuhai Huafa PropertiesLtd's is when the company's growth is on track to lag the market.

The only time you'd be truly comfortable seeing a P/E as low as Zhuhai Huafa PropertiesLtd's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 61%. The last three years don't look nice either as the company has shrunk EPS by 66% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 15% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is noticeably more attractive.

In light of this, it's understandable that Zhuhai Huafa PropertiesLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Zhuhai Huafa PropertiesLtd's P/E

The latest share price surge wasn't enough to lift Zhuhai Huafa PropertiesLtd's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Zhuhai Huafa PropertiesLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 6 warning signs for Zhuhai Huafa PropertiesLtd (1 can't be ignored!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.