Despite an already strong run, Cytosorbents Corporation (NASDAQ:CTSO) shares have been powering on, with a gain of 43% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

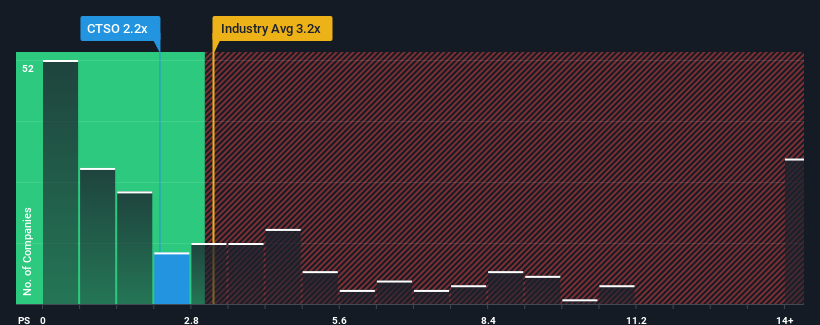

In spite of the firm bounce in price, Cytosorbents may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.2x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.2x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Cytosorbents' Recent Performance Look Like?

Cytosorbents could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Cytosorbents will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Cytosorbents' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Cytosorbents' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 18% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 17% per annum over the next three years. That's shaping up to be materially higher than the 9.2% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Cytosorbents' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Cytosorbents' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Cytosorbents' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Cytosorbents (of which 1 is a bit unpleasant!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.