Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Tianli International Holdings (HKG:1773). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Tianli International Holdings Growing Its Earnings Per Share?

Over the last three years, Tianli International Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Tianli International Holdings' EPS grew from CN¥0.11 to CN¥0.21, over the previous 12 months. It's a rarity to see 89% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the one hand, Tianli International Holdings' EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the one hand, Tianli International Holdings' EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

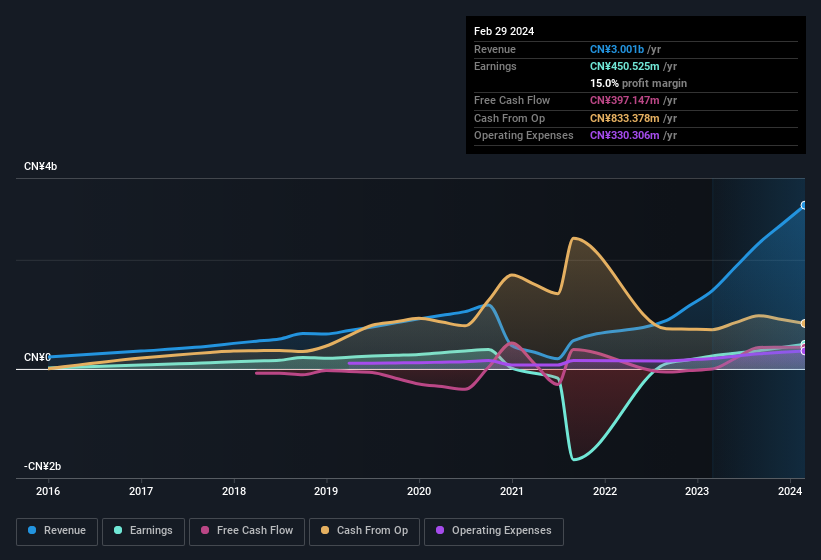

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Tianli International Holdings' forecast profits?

Are Tianli International Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One gleaming positive for Tianli International Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. In one fell swoop, Chairman of the Board & CEO Shi Luo, spent HK$4.6m, at a price of HK$3.20 per share. It doesn't get much better than that, in terms of large investments from insiders.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Tianli International Holdings will reveal that insiders own a significant piece of the pie. Owning 44% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. This insider holding amounts to That level of investment from insiders is nothing to sneeze at.

Does Tianli International Holdings Deserve A Spot On Your Watchlist?

Tianli International Holdings' earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Tianli International Holdings deserves timely attention. What about risks? Every company has them, and we've spotted 1 warning sign for Tianli International Holdings you should know about.

Keen growth investors love to see insider activity. Thankfully, Tianli International Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.