Xiamen R&T Plumbing Technology Co.,Ltd. (SZSE:002790) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

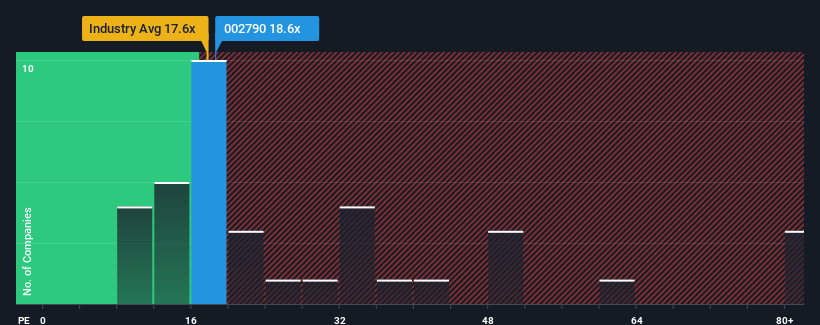

Although its price has surged higher, Xiamen R&T Plumbing TechnologyLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.6x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 58x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Xiamen R&T Plumbing TechnologyLtd has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

Xiamen R&T Plumbing TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Xiamen R&T Plumbing TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 52% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 17% per annum as estimated by the five analysts watching the company. With the market predicted to deliver 19% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Xiamen R&T Plumbing TechnologyLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Xiamen R&T Plumbing TechnologyLtd's P/E

The latest share price surge wasn't enough to lift Xiamen R&T Plumbing TechnologyLtd's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Xiamen R&T Plumbing TechnologyLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Xiamen R&T Plumbing TechnologyLtd you should be aware of.

If these risks are making you reconsider your opinion on Xiamen R&T Plumbing TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.