Despite an already strong run, National Silicon Industry Group Co.,Ltd. (SHSE:688126) shares have been powering on, with a gain of 29% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.0% in the last twelve months.

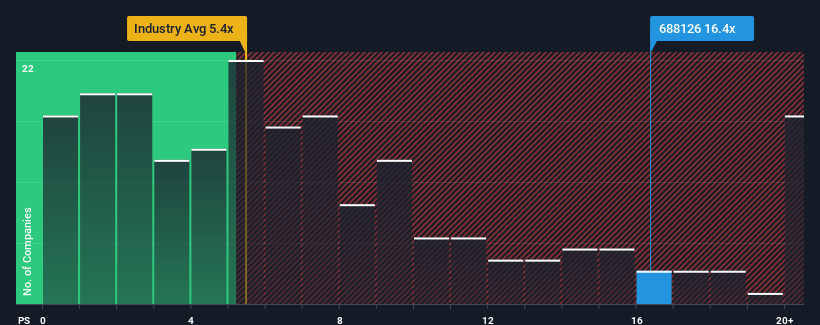

After such a large jump in price, National Silicon Industry GroupLtd may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 16.4x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 5.4x and even P/S lower than 2x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does National Silicon Industry GroupLtd's P/S Mean For Shareholders?

National Silicon Industry GroupLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think National Silicon Industry GroupLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For National Silicon Industry GroupLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like National Silicon Industry GroupLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like National Silicon Industry GroupLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.7%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 53% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 24% per year during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 39% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that National Silicon Industry GroupLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On National Silicon Industry GroupLtd's P/S

National Silicon Industry GroupLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see National Silicon Industry GroupLtd trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about this 1 warning sign we've spotted with National Silicon Industry GroupLtd.

If you're unsure about the strength of National Silicon Industry GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.