Hangzhou Electronic Soul Network Technology Co., Ltd. (SHSE:603258) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

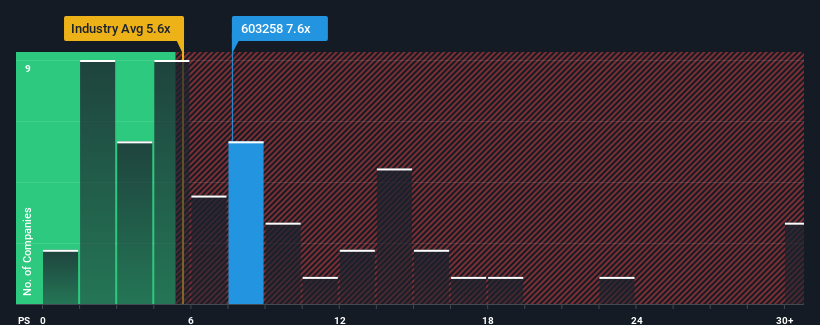

After such a large jump in price, given close to half the companies operating in China's Entertainment industry have price-to-sales ratios (or "P/S") below 5.6x, you may consider Hangzhou Electronic Soul Network Technology as a stock to potentially avoid with its 7.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Hangzhou Electronic Soul Network Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Hangzhou Electronic Soul Network Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Hangzhou Electronic Soul Network Technology's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Hangzhou Electronic Soul Network Technology would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, Hangzhou Electronic Soul Network Technology would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 6.6% decrease to the company's top line. As a result, revenue from three years ago have also fallen 40% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 51% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 28% growth forecast for the broader industry.

In light of this, it's understandable that Hangzhou Electronic Soul Network Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Hangzhou Electronic Soul Network Technology's P/S

Hangzhou Electronic Soul Network Technology shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Hangzhou Electronic Soul Network Technology shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 3 warning signs for Hangzhou Electronic Soul Network Technology that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.