Delixi New Energy Technology Co., Ltd. (SHSE:603032) shares have continued their recent momentum with a 33% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

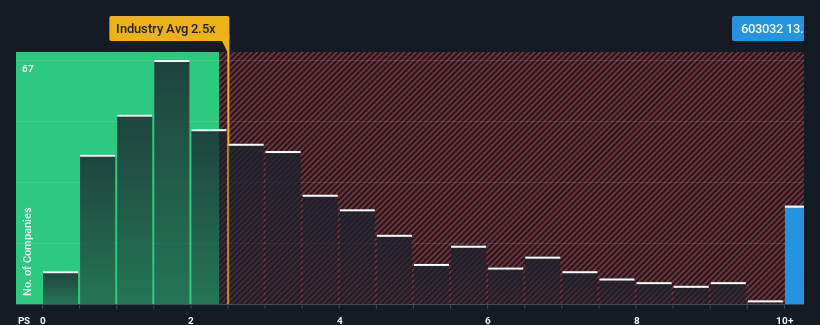

Following the firm bounce in price, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Delixi New Energy Technology as a stock not worth researching with its 13.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Delixi New Energy Technology Has Been Performing

Delixi New Energy Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Delixi New Energy Technology.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Delixi New Energy Technology would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Delixi New Energy Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 58% decrease to the company's top line. Even so, admirably revenue has lifted 190% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 22% as estimated by the sole analyst watching the company. That's shaping up to be similar to the 23% growth forecast for the broader industry.

In light of this, it's curious that Delixi New Energy Technology's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Delixi New Energy Technology's P/S

Shares in Delixi New Energy Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Delixi New Energy Technology currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 1 warning sign for Delixi New Energy Technology that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.