Despite an already strong run, NavInfo Co., Ltd. (SZSE:002405) shares have been powering on, with a gain of 28% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.4% in the last twelve months.

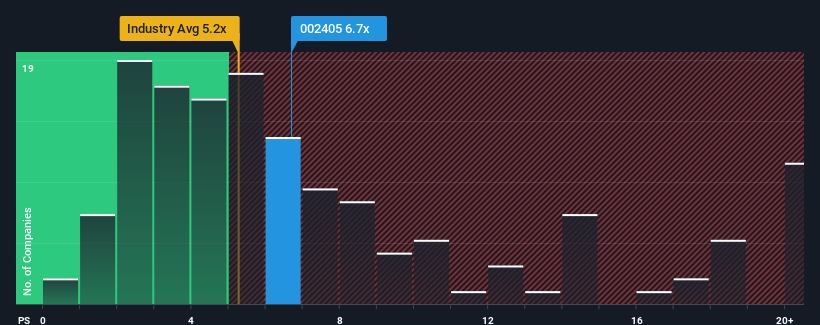

Following the firm bounce in price, given close to half the companies operating in China's Software industry have price-to-sales ratios (or "P/S") below 5.2x, you may consider NavInfo as a stock to potentially avoid with its 6.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has NavInfo Performed Recently?

NavInfo could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NavInfo.Is There Enough Revenue Growth Forecasted For NavInfo?

NavInfo's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

NavInfo's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.5%. Still, the latest three year period has seen an excellent 38% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the eight analysts following the company. That's shaping up to be materially lower than the 26% growth forecast for the broader industry.

With this information, we find it concerning that NavInfo is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

NavInfo's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for NavInfo, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for NavInfo you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.