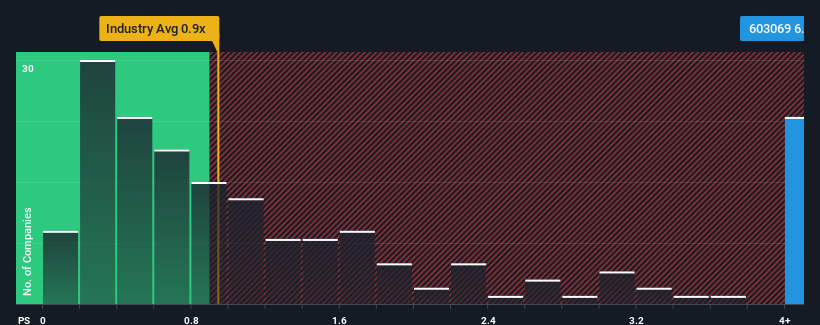

When close to half the companies in the Transportation industry in China have price-to-sales ratios (or "P/S") below 3x, you may consider Hainan Haiqi Transportation Group Co.,Ltd. (SHSE:603069) as a stock to avoid entirely with its 6.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Hainan Haiqi Transportation GroupLtd's Recent Performance Look Like?

The revenue growth achieved at Hainan Haiqi Transportation GroupLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Hainan Haiqi Transportation GroupLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Hainan Haiqi Transportation GroupLtd would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. As a result, it also grew revenue by 21% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. As a result, it also grew revenue by 21% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.2% shows it's about the same on an annualised basis.

In light of this, it's curious that Hainan Haiqi Transportation GroupLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What Does Hainan Haiqi Transportation GroupLtd's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Hainan Haiqi Transportation GroupLtd revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Hainan Haiqi Transportation GroupLtd has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Hainan Haiqi Transportation GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.