When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. For example, the Xiamen Wanli Stone Stock Co.,Ltd (SZSE:002785) share price is up 88% in the last 5 years, clearly besting the market return of around 17% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 11% in the last year.

Since it's been a strong week for Xiamen Wanli Stone StockLtd shareholders, let's have a look at trend of the longer term fundamentals.

Xiamen Wanli Stone StockLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Xiamen Wanli Stone StockLtd saw its revenue grow at 6.2% per year. That's a fairly respectable growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 13% full reflects the underlying business growth. If revenue growth can maintain for long enough, it's likely profits will flow. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

In the last 5 years Xiamen Wanli Stone StockLtd saw its revenue grow at 6.2% per year. That's a fairly respectable growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 13% full reflects the underlying business growth. If revenue growth can maintain for long enough, it's likely profits will flow. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

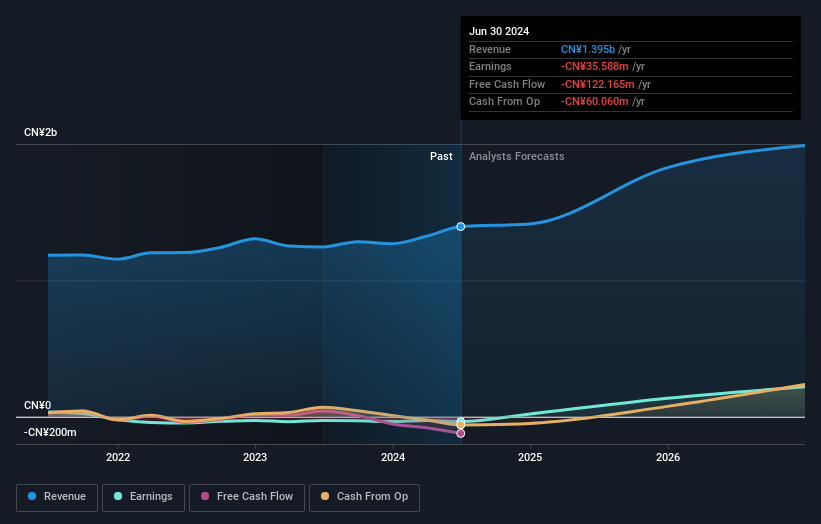

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Xiamen Wanli Stone StockLtd shareholders have received a total shareholder return of 11% over the last year. However, that falls short of the 13% TSR per annum it has made for shareholders, each year, over five years. It's always interesting to track share price performance over the longer term. But to understand Xiamen Wanli Stone StockLtd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Xiamen Wanli Stone StockLtd , and understanding them should be part of your investment process.

We will like Xiamen Wanli Stone StockLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.