It is a pleasure to report that the Dongguan Eontec Co., Ltd. (SZSE:300328) is up 76% in the last quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 18% in that half decade.

While the stock has risen 32% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

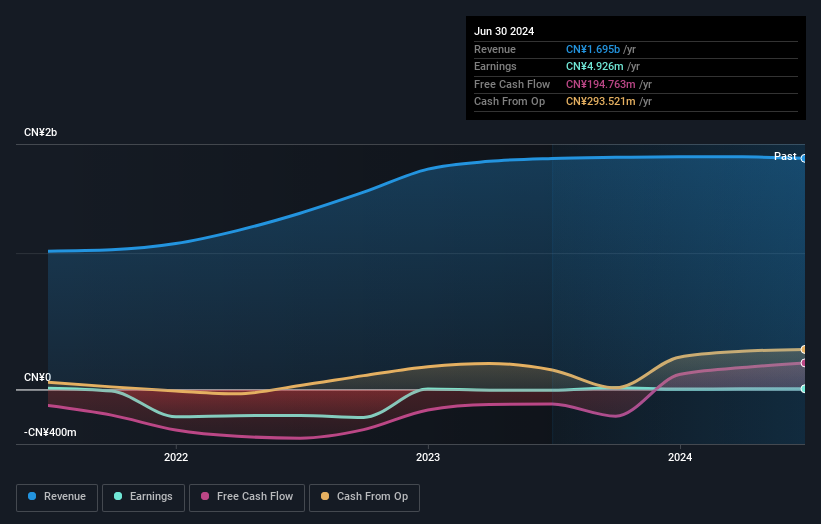

Given that Dongguan Eontec only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over five years, Dongguan Eontec grew its revenue at 14% per year. That's a pretty good rate for a long time period. Shareholders have seen the share price fall at 3% per year, for five years: a poor performance. Those who bought back then clearly believed in stronger growth - and maybe even profits. The lesson is that if you buy shares in a money losing company you could end up losing money.

Over five years, Dongguan Eontec grew its revenue at 14% per year. That's a pretty good rate for a long time period. Shareholders have seen the share price fall at 3% per year, for five years: a poor performance. Those who bought back then clearly believed in stronger growth - and maybe even profits. The lesson is that if you buy shares in a money losing company you could end up losing money.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Dongguan Eontec stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Dongguan Eontec shareholders have received a total shareholder return of 9.9% over the last year. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Dongguan Eontec (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

But note: Dongguan Eontec may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.