Investors with a lot of money to spend have taken a bullish stance on $UP Fintech (TIGR.US)$.

Today, Benzinga's options scanner spotted 33 uncommon options trades for UP Fintech Holding. The overall sentiment of these big-money traders is split between 45% bullish and 45%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $181,450, and 30 are calls, for a total amount of $1,241,915.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $17.0 for UP Fintech Holding during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $17.0 for UP Fintech Holding during the past quarter.

Analyzing Volume & Open Interest

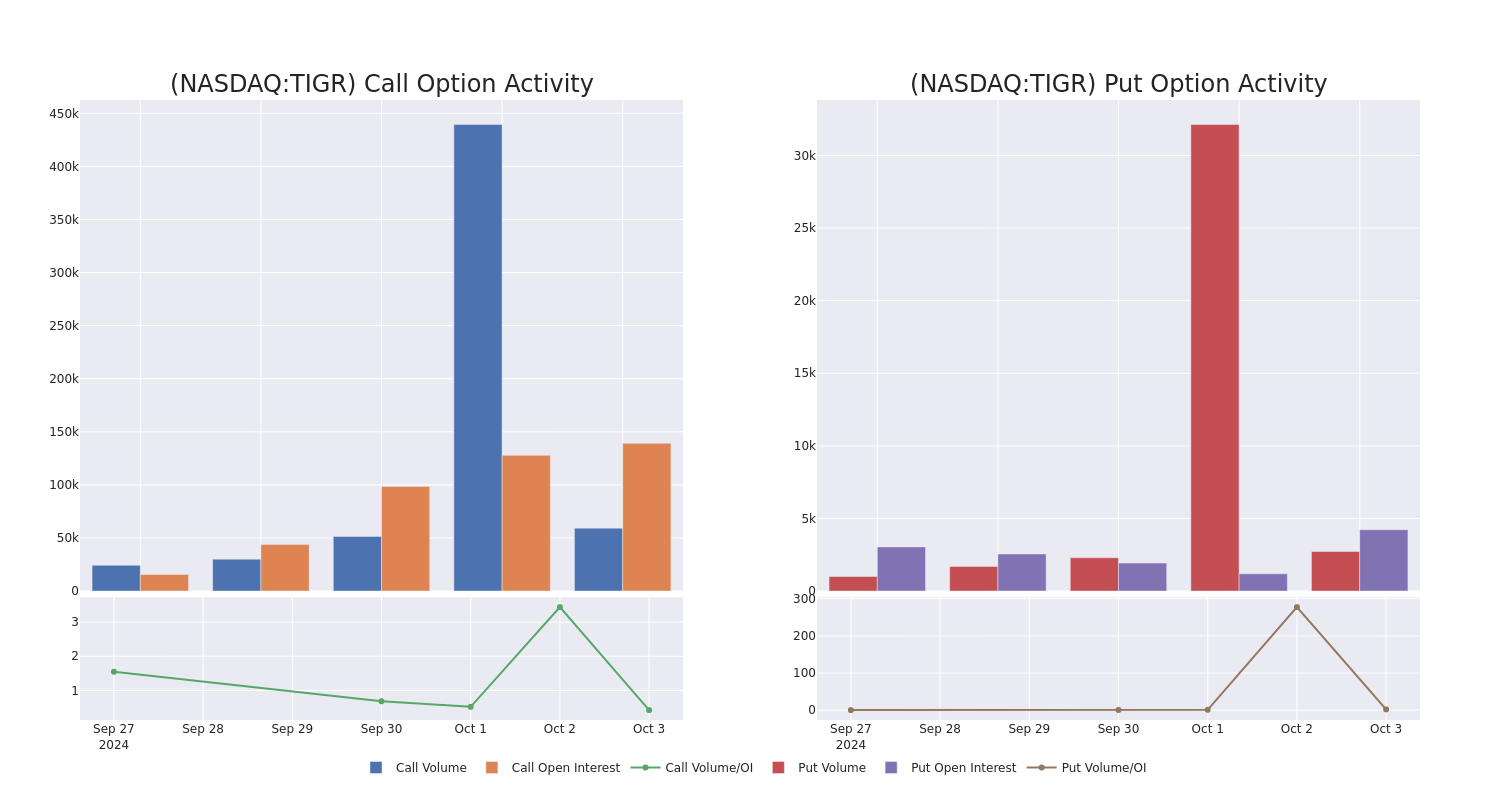

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for UP Fintech Holding's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UP Fintech Holding's whale trades within a strike price range from $5.0 to $17.0 in the last 30 days.

UP Fintech Holding Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

TIGR | CALL | TRADE | BEARISH | 10/18/24 | $3.7 | $3.5 | $3.56 | $5.50 | $106.8K | 2.8K | 813 |

TIGR | CALL | SWEEP | BULLISH | 11/15/24 | $1.5 | $1.4 | $1.5 | $10.00 | $75.0K | 10.0K | 2.4K |

TIGR | PUT | SWEEP | BEARISH | 11/15/24 | $0.85 | $0.75 | $0.75 | $7.00 | $74.9K | 1.0K | 1.7K |

TIGR | CALL | SWEEP | BEARISH | 11/15/24 | $2.5 | $2.35 | $2.35 | $8.00 | $70.5K | 4.1K | 920 |

TIGR | CALL | SWEEP | BEARISH | 10/18/24 | $1.25 | $1.2 | $1.2 | $10.00 | $69.3K | 9.8K | 6.7K |

About UP Fintech Holding

UP Fintech Holding Ltd is an online brokerage firm focusing on Chinese investors. Its trading platform enables investors to trade in equities and other financial instruments on multiple exchanges of stocks and other derivatives. The company offers its customers brokerage and value-added services, including trade order placement and execution, margin financing, account management, investor education, community discussion, and customer support.

After a thorough review of the options trading surrounding UP Fintech Holding, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of UP Fintech Holding

Currently trading with a volume of 17,126,367, the TIGR's price is up by 12.45%, now at $9.06.

RSI readings suggest the stock is currently may be overbought.

Anticipated earnings release is in 53 days.