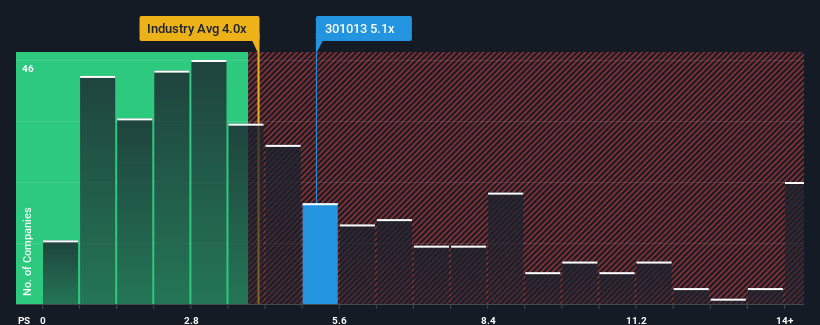

Shenzhen Lihexing Co.,Ltd.'s (SZSE:301013) price-to-sales (or "P/S") ratio of 5.1x might make it look like a sell right now compared to the Electronic industry in China, where around half of the companies have P/S ratios below 4x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Shenzhen LihexingLtd's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Shenzhen LihexingLtd has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen LihexingLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Shenzhen LihexingLtd would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 59% last year. The latest three year period has also seen a 22% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Taking a look back first, we see that the company grew revenue by an impressive 59% last year. The latest three year period has also seen a 22% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 111% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Shenzhen LihexingLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Shenzhen LihexingLtd's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Shenzhen LihexingLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Shenzhen LihexingLtd has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Shenzhen LihexingLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.