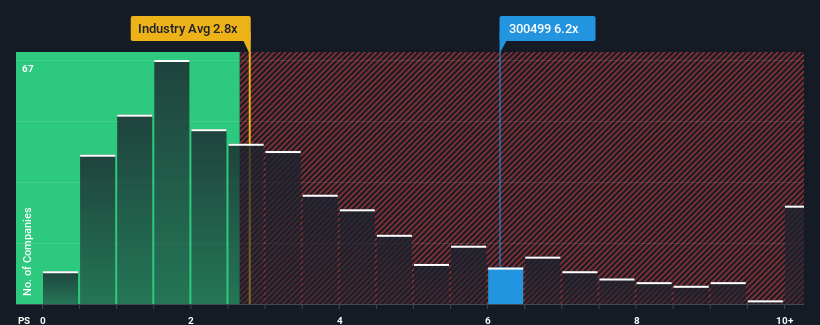

When close to half the companies in the Machinery industry in China have price-to-sales ratios (or "P/S") below 2.8x, you may consider Guangzhou Goaland Energy Conservation Tech. Co., Ltd. (SZSE:300499) as a stock to avoid entirely with its 6.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Guangzhou Goaland Energy Conservation Tech's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Guangzhou Goaland Energy Conservation Tech's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Guangzhou Goaland Energy Conservation Tech's future stacks up against the industry? In that case, our free report is a great place to start.How Is Guangzhou Goaland Energy Conservation Tech's Revenue Growth Trending?

In order to justify its P/S ratio, Guangzhou Goaland Energy Conservation Tech would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 55%. The last three years don't look nice either as the company has shrunk revenue by 56% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 55%. The last three years don't look nice either as the company has shrunk revenue by 56% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 59% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 23%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Guangzhou Goaland Energy Conservation Tech's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Guangzhou Goaland Energy Conservation Tech maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Guangzhou Goaland Energy Conservation Tech with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.