Financial giants have made a conspicuous bearish move on Wells Fargo. Our analysis of options history for Wells Fargo (NYSE:WFC) revealed 34 unusual trades.

Delving into the details, we found 11% of traders were bullish, while 70% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $511,054, and 26 were calls, valued at $1,380,926.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $62.5 for Wells Fargo during the past quarter.

Volume & Open Interest Trends

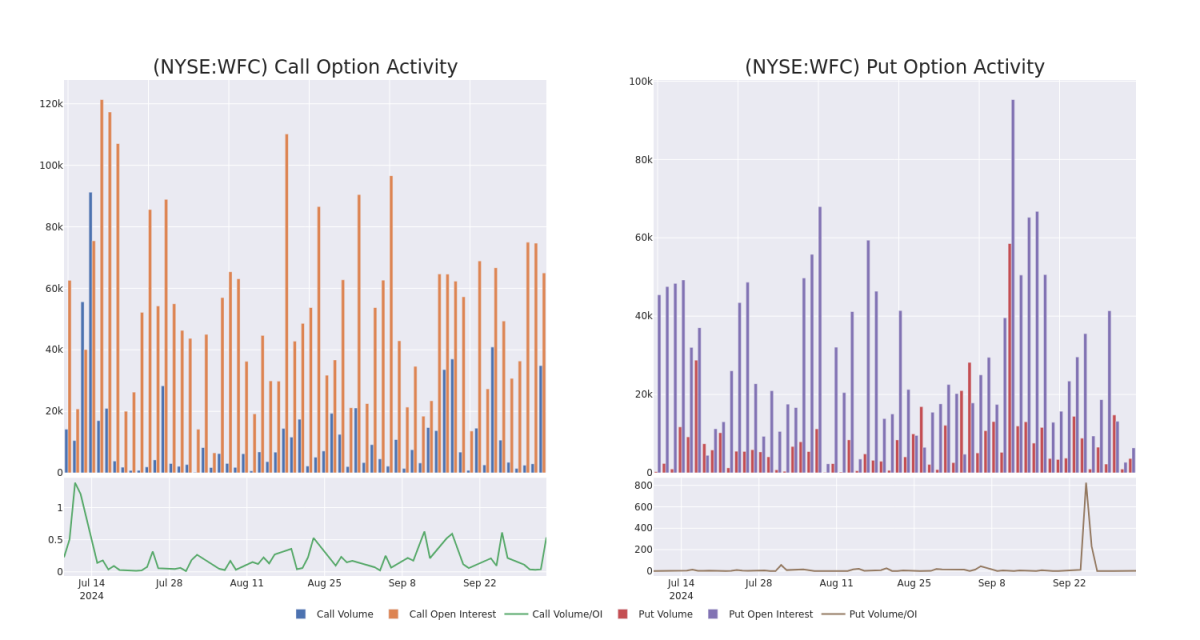

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Wells Fargo's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wells Fargo's whale activity within a strike price range from $45.0 to $62.5 in the last 30 days.

Wells Fargo 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | PUT | SWEEP | BULLISH | 02/21/25 | $5.75 | $5.65 | $5.65 | $60.00 | $168.9K | 246 | 300 |

| WFC | CALL | TRADE | BEARISH | 06/20/25 | $13.9 | $13.35 | $13.35 | $45.00 | $133.5K | 3.4K | 100 |

| WFC | CALL | SWEEP | BEARISH | 10/04/24 | $1.68 | $1.41 | $1.42 | $55.00 | $98.2K | 5.4K | 1.1K |

| WFC | CALL | SWEEP | BEARISH | 10/11/24 | $0.93 | $0.92 | $0.92 | $58.00 | $88.5K | 4.9K | 2.6K |

| WFC | PUT | SWEEP | BEARISH | 12/20/24 | $5.25 | $5.15 | $5.25 | $60.00 | $78.7K | 5.6K | 250 |

About Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

Having examined the options trading patterns of Wells Fargo, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Wells Fargo's Current Market Status

- Currently trading with a volume of 5,222,608, the WFC's price is up by 2.62%, now at $56.42.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 7 days.

Expert Opinions on Wells Fargo

4 market experts have recently issued ratings for this stock, with a consensus target price of $66.25.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Morgan Stanley persists with their Overweight rating on Wells Fargo, maintaining a target price of $67. * An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Wells Fargo, which currently sits at a price target of $68. * Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Wells Fargo, targeting a price of $65. * An analyst from Evercore ISI Group persists with their Outperform rating on Wells Fargo, maintaining a target price of $65.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.