Asiainfo Security Technologies Co.,Ltd. (SHSE:688225) shareholders have had their patience rewarded with a 42% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

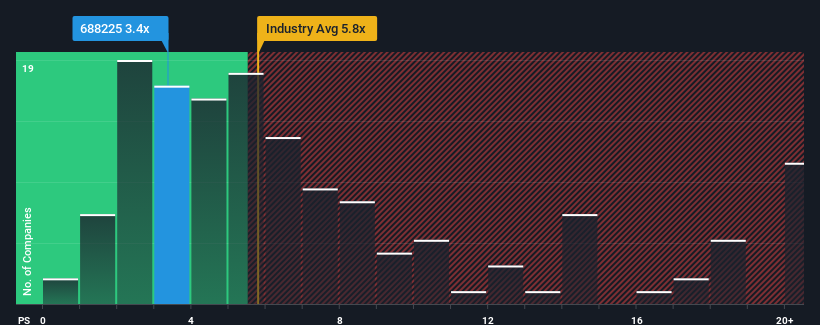

Although its price has surged higher, Asiainfo Security TechnologiesLtd's price-to-sales (or "P/S") ratio of 3.4x might still make it look like a buy right now compared to the Software industry in China, where around half of the companies have P/S ratios above 5.8x and even P/S above 11x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Asiainfo Security TechnologiesLtd Performed Recently?

Asiainfo Security TechnologiesLtd's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Asiainfo Security TechnologiesLtd will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Asiainfo Security TechnologiesLtd.How Is Asiainfo Security TechnologiesLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Asiainfo Security TechnologiesLtd would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Asiainfo Security TechnologiesLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 22% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 26% as estimated by the two analysts watching the company. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Asiainfo Security TechnologiesLtd's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Asiainfo Security TechnologiesLtd's P/S Mean For Investors?

Asiainfo Security TechnologiesLtd's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Asiainfo Security TechnologiesLtd's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Asiainfo Security TechnologiesLtd, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Asiainfo Security TechnologiesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.