Despite an already strong run, Winner Technology Co., Inc. (SZSE:300609) shares have been powering on, with a gain of 37% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 9.8% isn't as impressive.

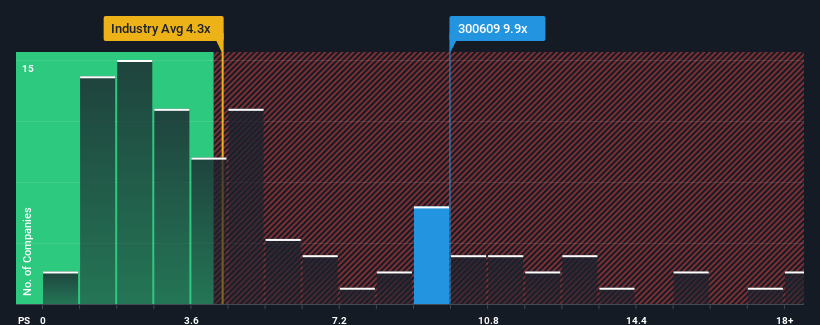

After such a large jump in price, Winner Technology may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 9.9x, since almost half of all companies in the IT industry in China have P/S ratios under 4.3x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Winner Technology Has Been Performing

The revenue growth achieved at Winner Technology over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Winner Technology's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Winner Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Winner Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. The latest three year period has also seen an excellent 49% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 20% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Winner Technology's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Winner Technology's P/S?

Winner Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Winner Technology currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You need to take note of risks, for example - Winner Technology has 4 warning signs (and 3 which can't be ignored) we think you should know about.

If these risks are making you reconsider your opinion on Winner Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.