Whales with a lot of money to spend have taken a noticeably bullish stance on Goldman Sachs Gr.

Looking at options history for Goldman Sachs Gr (NYSE:GS) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 35% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $99,920 and 11, calls, for a total amount of $907,069.

From the overall spotted trades, 3 are puts, for a total amount of $99,920 and 11, calls, for a total amount of $907,069.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $370.0 to $500.0 for Goldman Sachs Gr over the last 3 months.

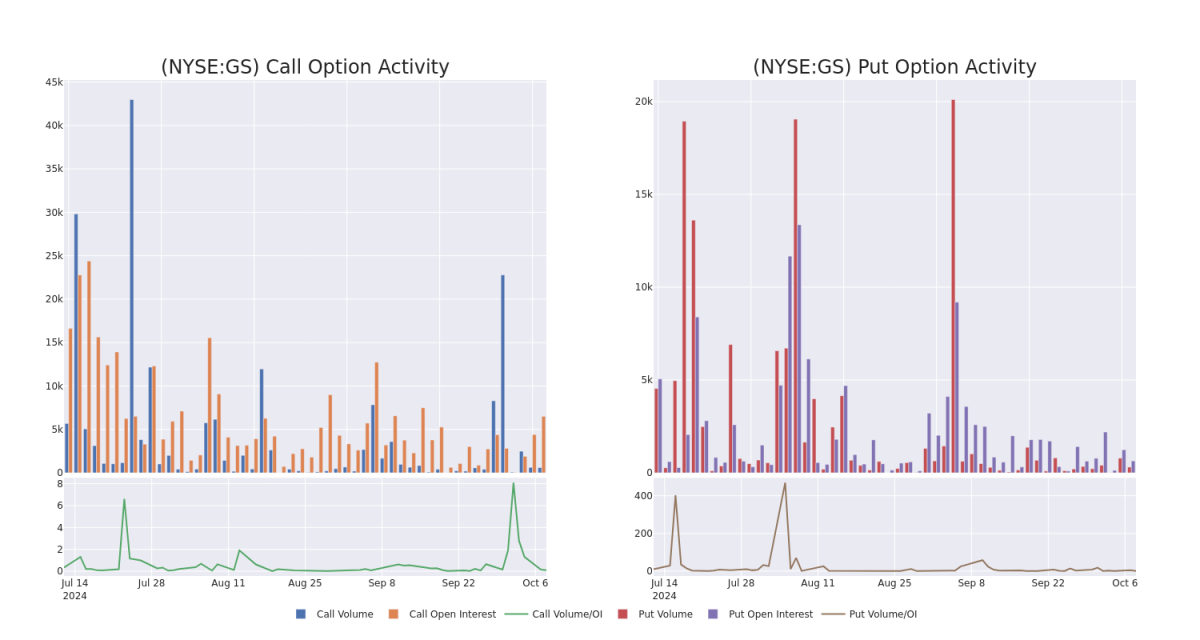

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Goldman Sachs Gr's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Goldman Sachs Gr's whale activity within a strike price range from $370.0 to $500.0 in the last 30 days.

Goldman Sachs Gr Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GS | CALL | SWEEP | BULLISH | 10/18/24 | $52.95 | $53.0 | $53.0 | $445.00 | $402.8K | 178 | 76 |

| GS | CALL | SWEEP | BULLISH | 10/18/24 | $53.0 | $51.8 | $53.0 | $445.00 | $127.2K | 178 | 100 |

| GS | CALL | SWEEP | BEARISH | 10/11/24 | $6.55 | $5.2 | $5.38 | $495.00 | $73.1K | 719 | 326 |

| GS | CALL | TRADE | NEUTRAL | 11/15/24 | $28.5 | $27.8 | $28.1 | $485.00 | $56.2K | 153 | 20 |

| GS | CALL | TRADE | BULLISH | 12/20/24 | $23.6 | $23.35 | $23.6 | $500.00 | $47.2K | 528 | 21 |

About Goldman Sachs Gr

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

Goldman Sachs Gr's Current Market Status

- With a trading volume of 334,411, the price of GS is down by -0.16%, reaching $493.82.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 7 days from now.

Expert Opinions on Goldman Sachs Gr

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $524.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Goldman Sachs Gr, targeting a price of $472. * An analyst from Oppenheimer has decided to maintain their Outperform rating on Goldman Sachs Gr, which currently sits at a price target of $577.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Goldman Sachs Gr with Benzinga Pro for real-time alerts.