It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Kinetic Development Group (HKG:1277), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Kinetic Development Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Kinetic Development Group's EPS has grown 23% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Kinetic Development Group shareholders is that EBIT margins have grown from 52% to 56% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Kinetic Development Group shareholders is that EBIT margins have grown from 52% to 56% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

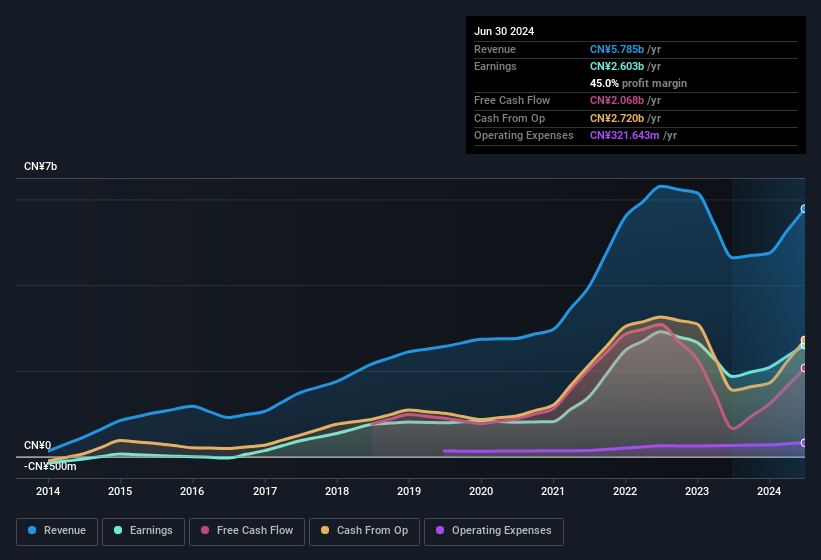

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Kinetic Development Group's balance sheet strength, before getting too excited.

Are Kinetic Development Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Kinetic Development Group insiders spent a whopping CN¥14m on stock in just one year, without so much as a single sale. Knowing this, Kinetic Development Group will have have all eyes on them in anticipation for the what could happen in the near future. It is also worth noting that it was company insider Li Zhang who made the biggest single purchase, worth HK$11m, paying HK$1.15 per share.

On top of the insider buying, we can also see that Kinetic Development Group insiders own a large chunk of the company. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. And their holding is extremely valuable at the current share price, totalling CN¥10b. This is an incredible endorsement from them.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Kinetic Development Group's CEO, Bo Li, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Kinetic Development Group, with market caps between CN¥7.1b and CN¥23b, is around CN¥3.5m.

The Kinetic Development Group CEO received CN¥2.4m in compensation for the year ending December 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Kinetic Development Group Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Kinetic Development Group's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 1 warning sign for Kinetic Development Group you should be aware of.

The good news is that Kinetic Development Group is not the only stock with insider buying. Here's a list of small cap, undervalued companies in HK with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.