The Shenzhen Jinjia Group Co.,Ltd. (SZSE:002191) share price has done very well over the last month, posting an excellent gain of 36%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

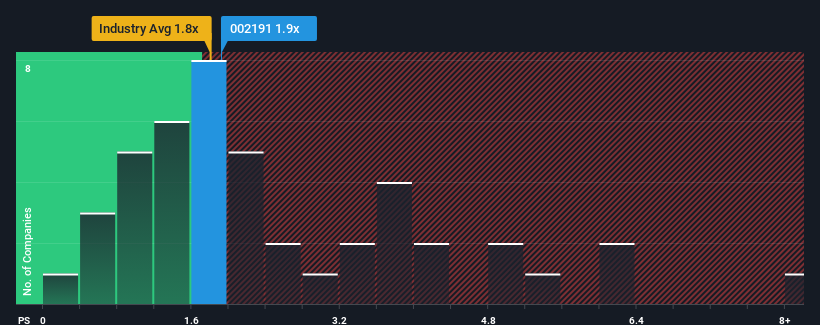

Although its price has surged higher, you could still be forgiven for feeling indifferent about Shenzhen Jinjia GroupLtd's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Packaging industry in China is also close to 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Shenzhen Jinjia GroupLtd Has Been Performing

While the industry has experienced revenue growth lately, Shenzhen Jinjia GroupLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Jinjia GroupLtd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Shenzhen Jinjia GroupLtd?

Shenzhen Jinjia GroupLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Shenzhen Jinjia GroupLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.8% as estimated by the one analyst watching the company. With the industry predicted to deliver 17% growth, that's a disappointing outcome.

With this information, we find it concerning that Shenzhen Jinjia GroupLtd is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Its shares have lifted substantially and now Shenzhen Jinjia GroupLtd's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of Shenzhen Jinjia GroupLtd's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You need to take note of risks, for example - Shenzhen Jinjia GroupLtd has 3 warning signs (and 2 which are significant) we think you should know about.

If these risks are making you reconsider your opinion on Shenzhen Jinjia GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.