The Jiangyin Zhongnan Heavy Industries Co.,Ltd (SZSE:002445) share price has done very well over the last month, posting an excellent gain of 39%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

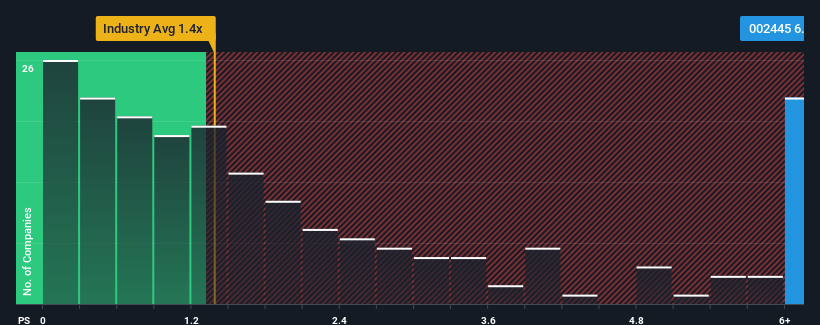

Following the firm bounce in price, given around half the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Jiangyin Zhongnan Heavy IndustriesLtd as a stock to avoid entirely with its 6.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Jiangyin Zhongnan Heavy IndustriesLtd Performed Recently?

The revenue growth achieved at Jiangyin Zhongnan Heavy IndustriesLtd over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangyin Zhongnan Heavy IndustriesLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangyin Zhongnan Heavy IndustriesLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangyin Zhongnan Heavy IndustriesLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 91% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 13% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Jiangyin Zhongnan Heavy IndustriesLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Jiangyin Zhongnan Heavy IndustriesLtd's P/S

Jiangyin Zhongnan Heavy IndustriesLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jiangyin Zhongnan Heavy IndustriesLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Plus, you should also learn about this 1 warning sign we've spotted with Jiangyin Zhongnan Heavy IndustriesLtd.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.