Guangdong Hybribio Biotech Co.,Ltd. (SZSE:300639) shares have continued their recent momentum with a 45% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

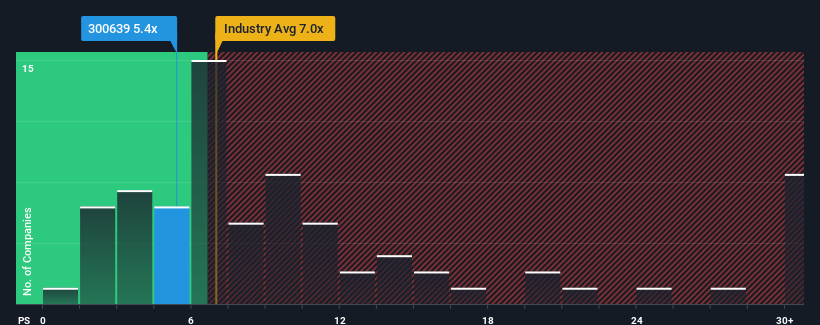

Even after such a large jump in price, Guangdong Hybribio BiotechLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 5.4x, considering almost half of all companies in the Biotechs industry in China have P/S ratios greater than 7x and even P/S higher than 13x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Guangdong Hybribio BiotechLtd Has Been Performing

For example, consider that Guangdong Hybribio BiotechLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangdong Hybribio BiotechLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Guangdong Hybribio BiotechLtd would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Guangdong Hybribio BiotechLtd would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 73%. The last three years don't look nice either as the company has shrunk revenue by 58% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 230% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Guangdong Hybribio BiotechLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Guangdong Hybribio BiotechLtd's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Guangdong Hybribio BiotechLtd's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Guangdong Hybribio BiotechLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Guangdong Hybribio BiotechLtd that we have uncovered.

If you're unsure about the strength of Guangdong Hybribio BiotechLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.