China Reinsurance (Group) Corporation (HKG:1508) shares have continued their recent momentum with a 45% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 92% in the last year.

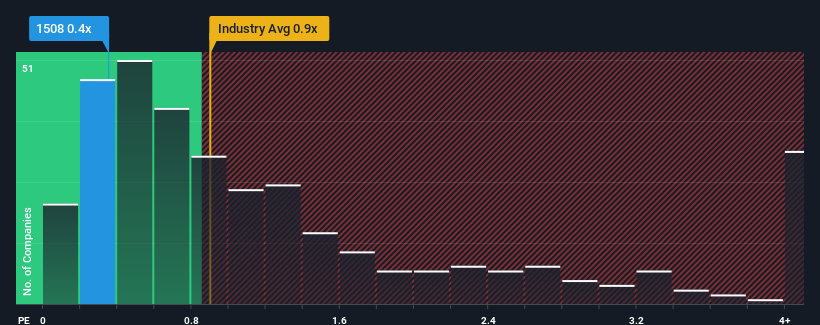

Even after such a large jump in price, it's still not a stretch to say that China Reinsurance (Group)'s price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Insurance industry in Hong Kong, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does China Reinsurance (Group)'s Recent Performance Look Like?

Recent times haven't been great for China Reinsurance (Group) as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on China Reinsurance (Group) will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like China Reinsurance (Group)'s to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like China Reinsurance (Group)'s to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 32% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 26% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to contract by 4.2%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that China Reinsurance (Group)'s P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On China Reinsurance (Group)'s P/S

China Reinsurance (Group) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We note that even though China Reinsurance (Group) trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - China Reinsurance (Group) has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on China Reinsurance (Group), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.