Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Ninestar Corporation (SZSE:002180) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Ninestar's Net Debt?

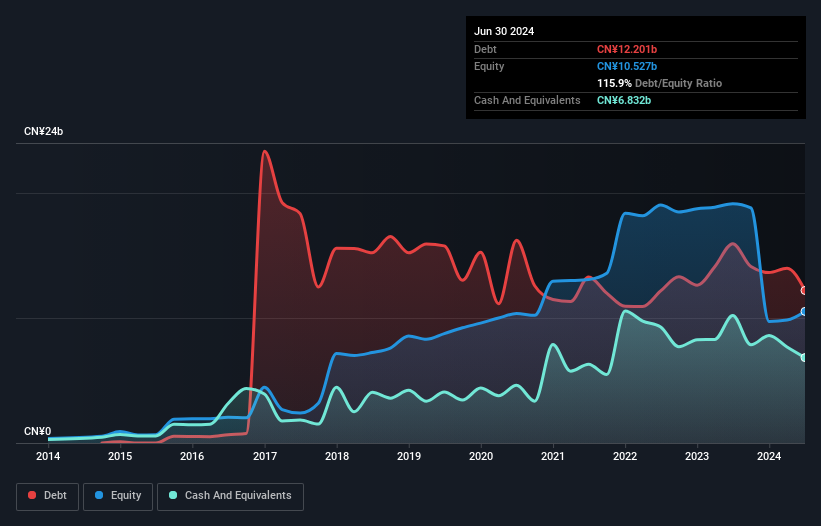

You can click the graphic below for the historical numbers, but it shows that Ninestar had CN¥12.2b of debt in June 2024, down from CN¥15.9b, one year before. However, because it has a cash reserve of CN¥6.83b, its net debt is less, at about CN¥5.37b.

A Look At Ninestar's Liabilities

According to the last reported balance sheet, Ninestar had liabilities of CN¥10.8b due within 12 months, and liabilities of CN¥15.8b due beyond 12 months. On the other hand, it had cash of CN¥6.83b and CN¥5.03b worth of receivables due within a year. So its liabilities total CN¥14.7b more than the combination of its cash and short-term receivables.

According to the last reported balance sheet, Ninestar had liabilities of CN¥10.8b due within 12 months, and liabilities of CN¥15.8b due beyond 12 months. On the other hand, it had cash of CN¥6.83b and CN¥5.03b worth of receivables due within a year. So its liabilities total CN¥14.7b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Ninestar is worth CN¥40.5b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Ninestar has a quite reasonable net debt to EBITDA multiple of 2.4, its interest cover seems weak, at 2.5. This does have us wondering if the company pays high interest because it is considered risky. In any case, it's safe to say the company has meaningful debt. Importantly, Ninestar's EBIT fell a jaw-dropping 32% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Ninestar's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Ninestar produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Ninestar's EBIT growth rate was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. In particular, its conversion of EBIT to free cash flow was re-invigorating. When we consider all the factors discussed, it seems to us that Ninestar is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Ninestar that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.