The Qingdao Kutesmart Co.,Ltd. (SZSE:300840) share price has done very well over the last month, posting an excellent gain of 46%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 38% in the last twelve months.

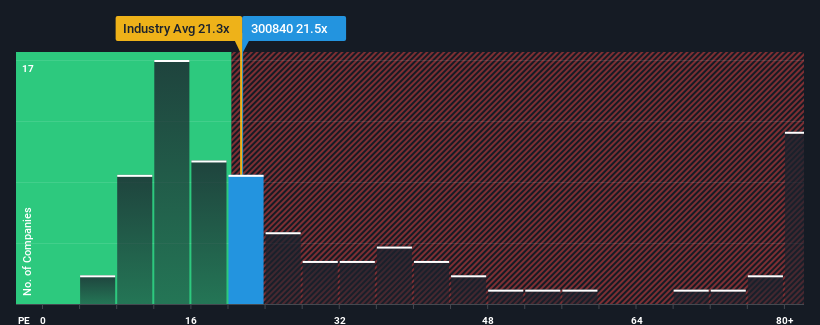

Even after such a large jump in price, Qingdao KutesmartLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 21.5x, since almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 67x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Earnings have risen firmly for Qingdao KutesmartLtd recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is Qingdao KutesmartLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Qingdao KutesmartLtd's is when the company's growth is on track to lag the market.

The only time you'd be truly comfortable seeing a P/E as low as Qingdao KutesmartLtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 15%. The strong recent performance means it was also able to grow EPS by 312% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Qingdao KutesmartLtd is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Qingdao KutesmartLtd's P/E

Qingdao KutesmartLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Qingdao KutesmartLtd revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Qingdao KutesmartLtd, and understanding should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.