During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

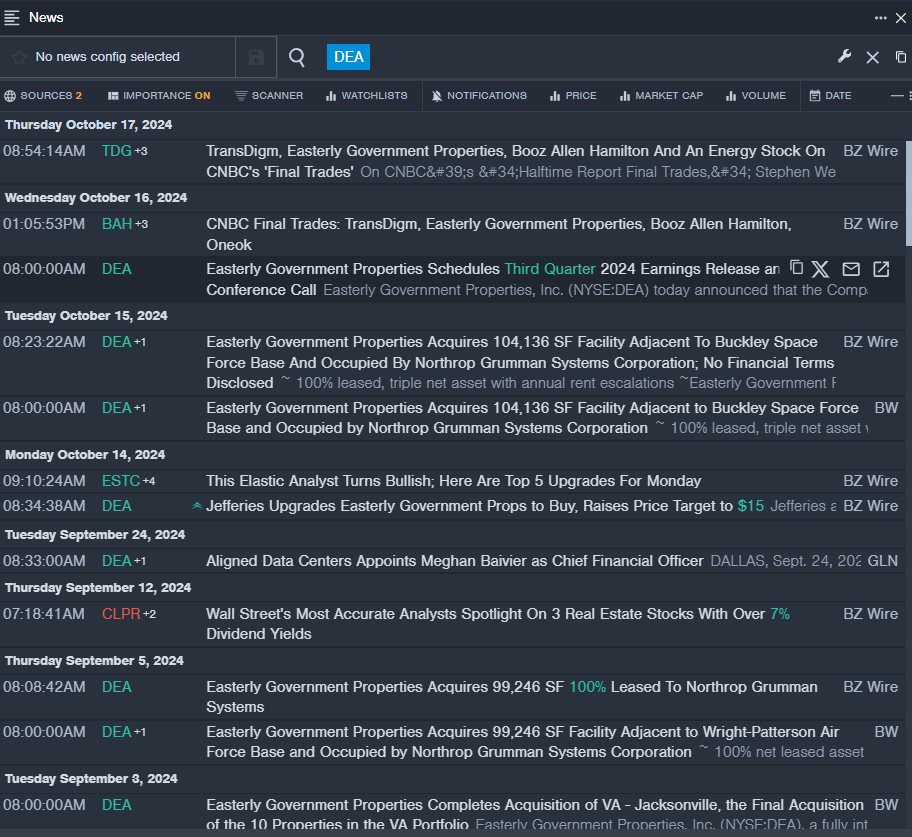

Easterly Government Properties, Inc. (NYSE:DEA)

- Dividend Yield: 7.64%

- Truist Securities analyst Michael Lewis maintained a Hold rating and raised the price target from $13 to $14 on Aug. 29. This analyst has an accuracy rate of 71%.

- RBC Capital analyst Michael Leithead Carroll downgraded the stock from Sector Perform to Underperform and cut the price target from $15 to $13 on Aug. 16, 2023. This analyst has an accuracy rate of 63%.

- Recent News: Easterly Government Properties will release its third quarter 2024 financial results on Nov. 5.

- Benzinga Pro's real-time newsfeed alerted to latest DEA news.

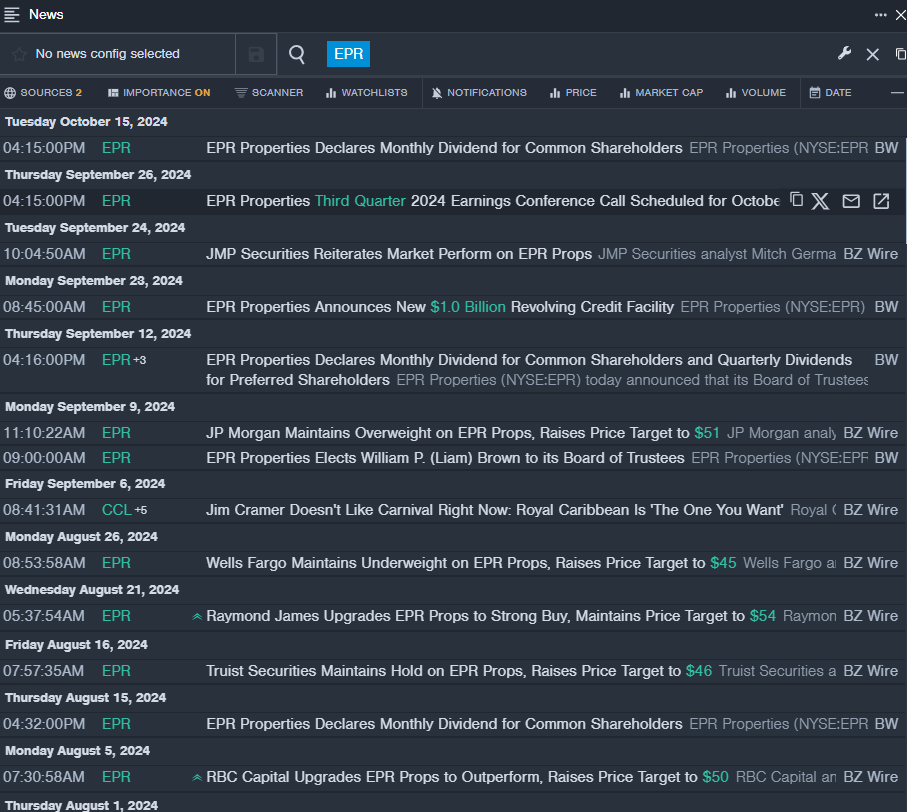

EPR Properties (NYSE:EPR)

- Dividend Yield: 7.26%

- JP Morgan analyst Anthony Paolone maintained an Overweight rating and raised the price target from $48 to $51 on Sept. 9. This analyst has an accuracy rate of 66%.

- Truist Securities analyst Ki Bin Kim maintained a Hold rating and boosted the price target from $44 to $46 on Aug. 16. This analyst has an accuracy rate of 69%.

- Recent News: EPR Properties will release its third quarter 2024 financial results after closing bell on Wednesday, Oct. 30.

- Benzinga Pro's real-time newsfeed alerted to latest EPR news.

OUTFRONT Media Inc. (NYSE:OUT)

- Dividend Yield: 6.46%

- JP Morgan analyst Richard Choe maintained a Neutral rating and raised the price target from $17 to $18 on July 31. This analyst has an accuracy rate of 62%.

- TD Cowen analyst Lance Vitanza initiated coverage on the stock a Hold rating with a price target of $16 on July 16. This analyst has an accuracy rate of 79%.

- Recent News: OUTFRONT Media will report results for the fiscal quarter ended Sept. 30, after the market closes on Tuesday, Nov. 5.

- Benzinga Pro's charting tool helped identify the trend in OUT stock.

Read More:

Read More:

- Jim Cramer Says 'Hold On' To Palantir, 'Let Them Walk It Up'; Warns That Travere Therapeutics Is Losing A 'Ton Of Money'