Despite an already strong run, Jiangnan Yifan Motor Co.,Ltd (SZSE:301023) shares have been powering on, with a gain of 25% in the last thirty days. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

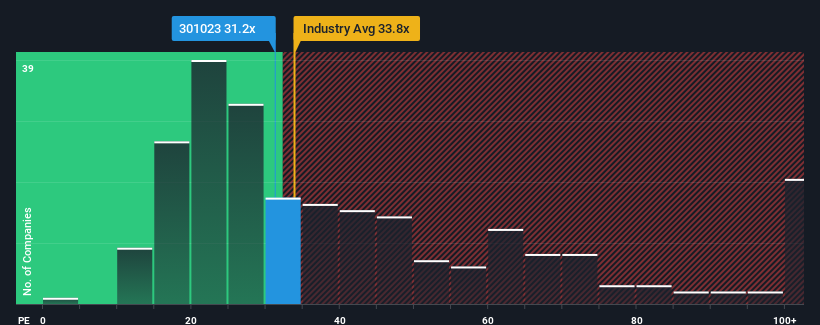

In spite of the firm bounce in price, it's still not a stretch to say that Jiangnan Yifan MotorLtd's price-to-earnings (or "P/E") ratio of 31.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 34x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, Jiangnan Yifan MotorLtd has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

How Is Jiangnan Yifan MotorLtd's Growth Trending?

The only time you'd be comfortable seeing a P/E like Jiangnan Yifan MotorLtd's is when the company's growth is tracking the market closely.

The only time you'd be comfortable seeing a P/E like Jiangnan Yifan MotorLtd's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 54% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 39% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Jiangnan Yifan MotorLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Jiangnan Yifan MotorLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Jiangnan Yifan MotorLtd currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Jiangnan Yifan MotorLtd (2 are a bit concerning) you should be aware of.

If you're unsure about the strength of Jiangnan Yifan MotorLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.