Those holding The Beauty Health Company (NASDAQ:SKIN) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 59% share price decline over the last year.

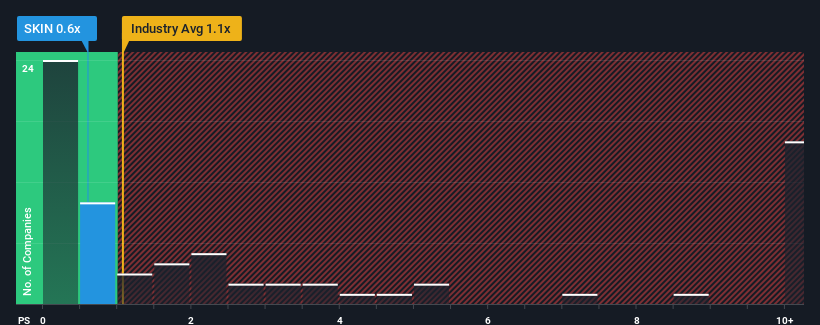

In spite of the firm bounce in price, it's still not a stretch to say that Beauty Health's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Personal Products industry in the United States, where the median P/S ratio is around 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Beauty Health's Recent Performance Look Like?

Beauty Health could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Beauty Health's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Beauty Health?

The only time you'd be comfortable seeing a P/S like Beauty Health's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Beauty Health's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.3%. Even so, admirably revenue has lifted 96% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 4.2% each year as estimated by the eleven analysts watching the company. That's shaping up to be similar to the 4.7% per year growth forecast for the broader industry.

In light of this, it's understandable that Beauty Health's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Beauty Health appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Beauty Health's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Beauty Health.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.