Sunsea AIoT Technology Co., Ltd. (SZSE:002313) shareholders will doubtless be very grateful to see the share price up 31% in the last quarter. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 48% in that half decade.

The recent uptick of 27% could be a positive sign of things to come, so let's take a look at historical fundamentals.

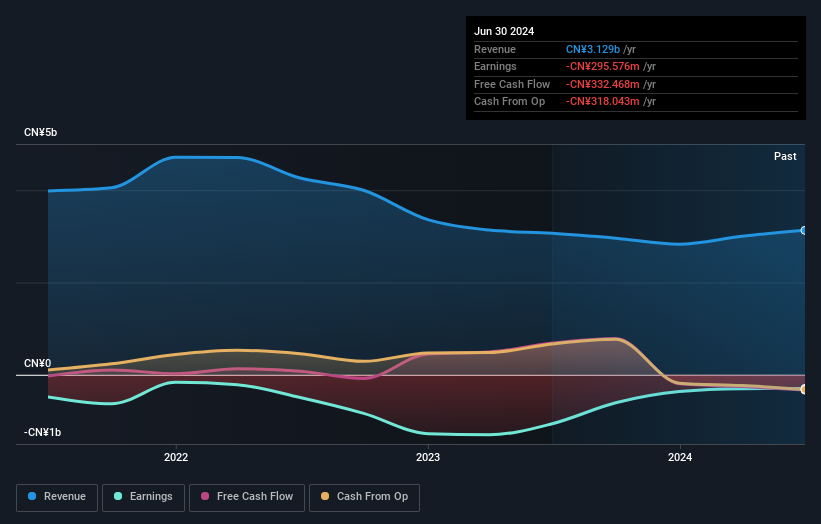

Given that Sunsea AIoT Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Sunsea AIoT Technology saw its revenue shrink by 9.4% per year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 8% per year in that time. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

In the last five years Sunsea AIoT Technology saw its revenue shrink by 9.4% per year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 8% per year in that time. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Sunsea AIoT Technology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Sunsea AIoT Technology shareholders have received a total shareholder return of 26% over one year. That certainly beats the loss of about 8% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Sunsea AIoT Technology you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.