Whales with a lot of money to spend have taken a noticeably bearish stance on PDD Holdings.

Looking at options history for PDD Holdings (NASDAQ:PDD) we detected 37 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 54% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $1,051,483 and 26, calls, for a total amount of $2,542,190.

From the overall spotted trades, 11 are puts, for a total amount of $1,051,483 and 26, calls, for a total amount of $2,542,190.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $110.0 and $190.0 for PDD Holdings, spanning the last three months.

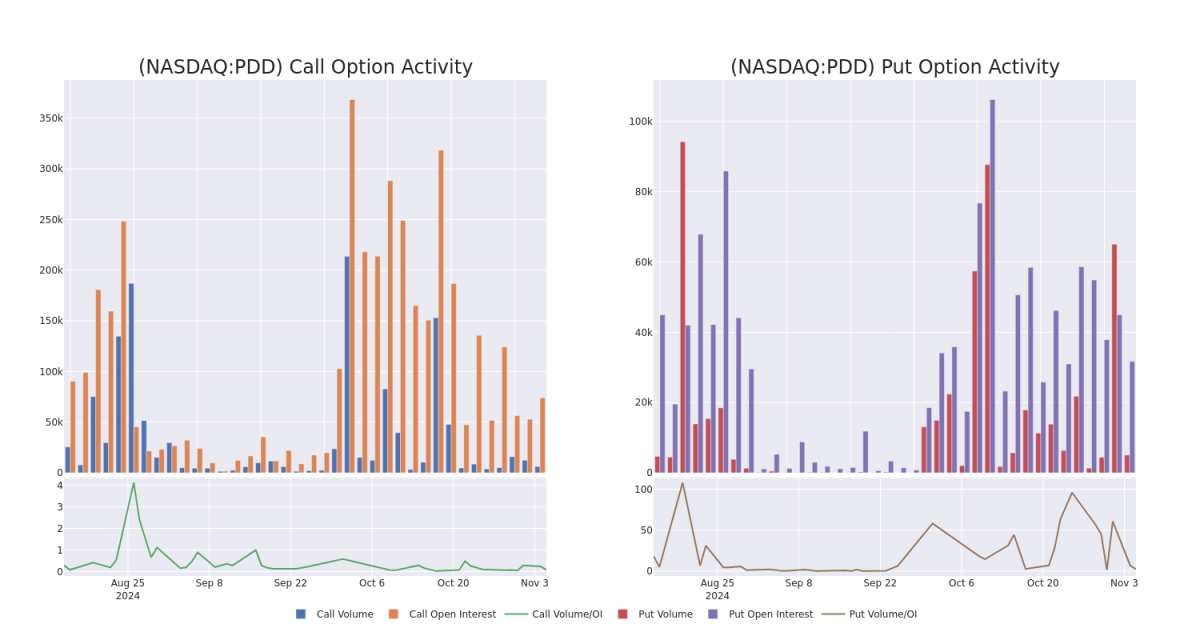

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PDD Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PDD Holdings's significant trades, within a strike price range of $110.0 to $190.0, over the past month.

PDD Holdings 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | BEARISH | 03/21/25 | $6.05 | $5.85 | $5.85 | $155.00 | $818.9K | 1.9K | 1.4K |

| PDD | CALL | SWEEP | BULLISH | 01/16/26 | $22.65 | $22.6 | $22.64 | $135.00 | $221.6K | 2.5K | 189 |

| PDD | CALL | SWEEP | BULLISH | 01/16/26 | $22.6 | $22.55 | $22.62 | $135.00 | $203.3K | 2.5K | 91 |

| PDD | PUT | TRADE | BEARISH | 06/20/25 | $39.65 | $38.8 | $39.35 | $155.00 | $196.7K | 362 | 50 |

| PDD | PUT | TRADE | BEARISH | 06/20/25 | $35.6 | $34.85 | $35.4 | $150.00 | $177.0K | 1.3K | 50 |

About PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

Following our analysis of the options activities associated with PDD Holdings, we pivot to a closer look at the company's own performance.

PDD Holdings's Current Market Status

- With a volume of 2,881,166, the price of PDD is up 0.27% at $122.64.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 21 days.

What The Experts Say On PDD Holdings

In the last month, 1 experts released ratings on this stock with an average target price of $224.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Macquarie upgraded its action to Outperform with a price target of $224.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.