Whales with a lot of money to spend have taken a noticeably bearish stance on Marvell Tech.

Looking at options history for Marvell Tech (NASDAQ:MRVL) we detected 18 trades.

If we consider the specifics of each trade, it is accurate to state that 27% of the investors opened trades with bullish expectations and 61% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $207,135 and 15, calls, for a total amount of $1,072,934.

From the overall spotted trades, 3 are puts, for a total amount of $207,135 and 15, calls, for a total amount of $1,072,934.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $120.0 for Marvell Tech during the past quarter.

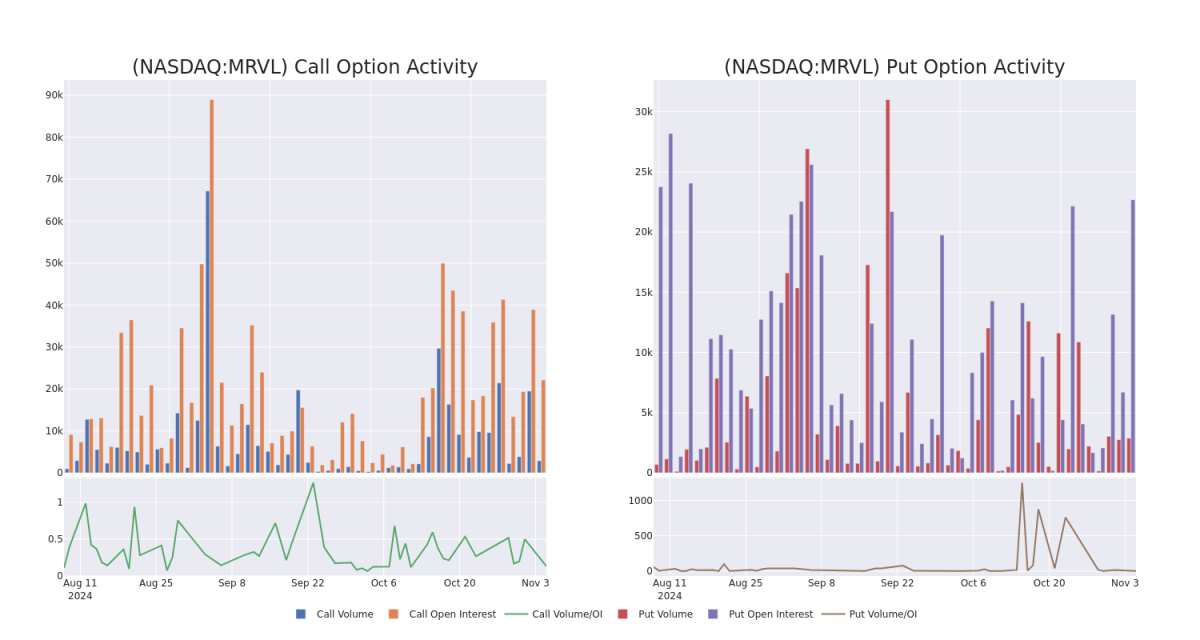

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Marvell Tech options trades today is 3199.64 with a total volume of 5,642.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Marvell Tech's big money trades within a strike price range of $60.0 to $120.0 over the last 30 days.

Marvell Tech Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | CALL | SWEEP | BEARISH | 12/20/24 | $18.2 | $18.05 | $18.05 | $70.00 | $180.5K | 1.1K | 105 |

| MRVL | CALL | SWEEP | BULLISH | 12/20/24 | $18.05 | $18.05 | $18.05 | $70.00 | $180.5K | 1.1K | 205 |

| MRVL | CALL | TRADE | BEARISH | 06/20/25 | $4.85 | $4.6 | $4.6 | $120.00 | $120.9K | 11 | 264 |

| MRVL | CALL | SWEEP | BEARISH | 11/08/24 | $4.55 | $3.55 | $3.9 | $84.00 | $107.2K | 1.4K | 275 |

| MRVL | PUT | SWEEP | BULLISH | 11/22/24 | $0.19 | $0.06 | $0.06 | $60.00 | $104.3K | 17.3K | 2.2K |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Following our analysis of the options activities associated with Marvell Tech, we pivot to a closer look at the company's own performance.

Present Market Standing of Marvell Tech

- Currently trading with a volume of 3,848,760, the MRVL's price is up by 1.65%, now at $85.77.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 24 days.

What Analysts Are Saying About Marvell Tech

1 market experts have recently issued ratings for this stock, with a consensus target price of $91.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Citigroup persists with their Buy rating on Marvell Tech, maintaining a target price of $91.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.