$Zip Co Ltd (ZIP.AU)$ shares rose 5.42% on Wednesday, with trading volume expanding to A$35.79 million. Zip has rose 3.81% over the past week, with a cumulative gain of 393.70% year-to-date.

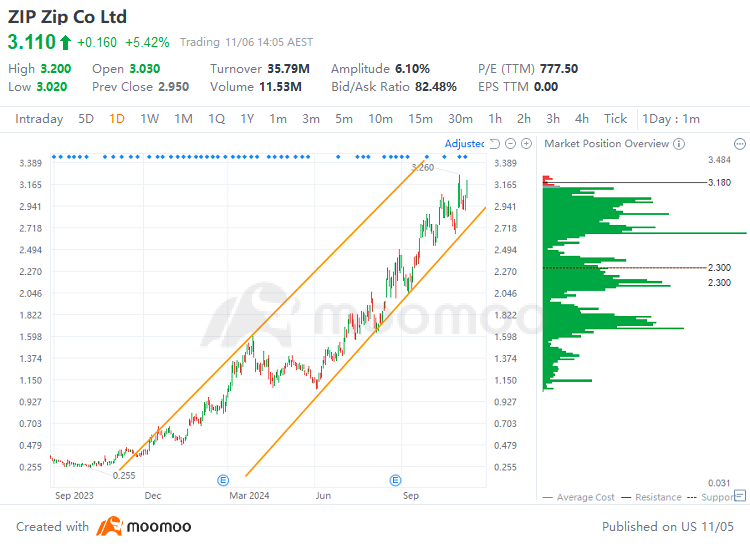

Zip's technical analysis chart:

Technical Analysis:

Support: A$3.16

Resistance: A$2.63

Resistance: A$2.63

Price range A$2.63 to A$3.16: The trading range indicates a heavy concentration of buy orders, with the stock price on an upward trend. The stock repeatedly touched the level near A$2.63, where it found significant support and subsequently rebounded. There is a strong presence of buy orders around A$2.63, suggesting a robust foundation for the price. There is considerable upward pressure near the resistance level of A$3.16, with a lot of profit-taking positions, which suggests strong selling pressure. Going forward, it will be crucial to monitor whether the stock can effectively break through the resistance level at A$3.16.

Market News :

Zip announced its first-quarter earnings on October 29, reporting a significant financial boost due to a 40% year-over-year increase in usage in the U.S., its largest economy. The company posted cash earnings before tax, depreciation, and amortization of A$31.7 million for the three months ending September, which is more than three times the amount from the same period last year. Revenue for the period also saw a 19% increase, reaching A$239.9 million, with the U.S. contributing notably to this growth with a 40% increase to A$137.4 million. The total number of transactions on Zip's platform grew 18%, amounting to 21.3 million, driven by a substantial 40% increase in the U.S. to 10.3 million transactions.

Zip disclosed a shift in the indirect holdings of its director, Kevin Moss, who has recently purchased 3,250 fully paid ordinary shares in a market transaction, valued at around US$6,342. This transaction signifies an important development for stakeholders and shareholders, indicating active involvement by the company's leadership in its equity instruments.

Overall Analysis:

Fundamentally, focus on the company's performance and operational status. Technically, it is necessary to monitor whether the stock price continues to stay within the upward channel, whether the support at the bottom of the channel remains valid, and whether the resistance level can be effectively broken through.

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

Source: ZIP, bloomberg

$Zip Co Ltd (ZIP.AU)$ 水曜日に株価は5.42%上昇し、取引量はA$3579万に拡大しました。Zipは過去1週間で3.81%上昇し、年初来で393.70%の累積利益を上げています。

Zipのテクニカル分析チャート:

テクニカル分析:

ニュース:

Zipは10月29日に第1四半期の業績を発表し、最大の経済であるアメリカでの利用が前年比40%増加したことにより、著しい財務増加を報告しました。同社は、9月末までの3か月間の税引前のキャッシュ収益、減価償却前収益、および償却前収益がA$31.7 millionで、前年同期の金額の3倍以上です。期間の売上高も19%増のA$239.9 millionとなり、アメリカがA$137.4 millionへの40%増加でこの伸びに顕著に貢献しました。Zipのプラットフォーム上の取引総数は18%増の2130万となり、アメリカの1030万取引の40%増加が牽引しました。

Zipは、取締役であるKevin Mossの間接保有の変化を開示しました。Moss氏は最近、市場取引で約US$6,342で評価される3,250株の完全支払普通株を購入しました。この取引は、利害関係者と株主にとって重要な展開を示しており、企業のリーダーシップが自己資本証券への積極的な関与を示しています。

総合分析:

基本的には、企業の業績と運営状況に焦点を当てるべきです。技術的には、株価が上昇チャネル内に留まり続けているか、チャネルの底でのサポートが有効であるか、抵抗レベルが効果的に突破できるかを監視する必要があります。

このシナリオでは、投資家は慎重な戦略を採用するべきであり、リスクを管理するためにストップロスポイントを設定し、企業の動向や市場状況について継続的な警戒を保つべきです。

出典:ZIP、ブルームバーグ

サポート: A$3.16

サポート: A$3.16

Resistance: A$2.63

Resistance: A$2.63