Despite an already strong run, AtriCure, Inc. (NASDAQ:ATRC) shares have been powering on, with a gain of 28% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.4% in the last twelve months.

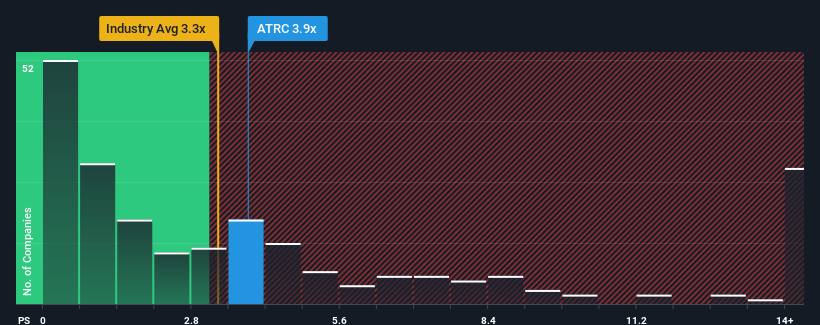

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about AtriCure's P/S ratio of 3.9x, since the median price-to-sales (or "P/S") ratio for the Medical Equipment industry in the United States is also close to 3.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has AtriCure Performed Recently?

With revenue growth that's superior to most other companies of late, AtriCure has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on AtriCure will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, AtriCure would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, AtriCure would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen an excellent 73% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 15% per annum over the next three years. That's shaping up to be materially higher than the 9.3% per year growth forecast for the broader industry.

In light of this, it's curious that AtriCure's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On AtriCure's P/S

AtriCure appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that AtriCure currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for AtriCure that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.