Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. For example, the The RealReal, Inc. (NASDAQ:REAL) share price had more than doubled in just one year - up 127%. It's also good to see the share price up 54% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Zooming out, the stock is actually down 78% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Because RealReal made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, RealReal's revenue grew by 2.5%. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 127%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

Over the last twelve months, RealReal's revenue grew by 2.5%. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 127%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

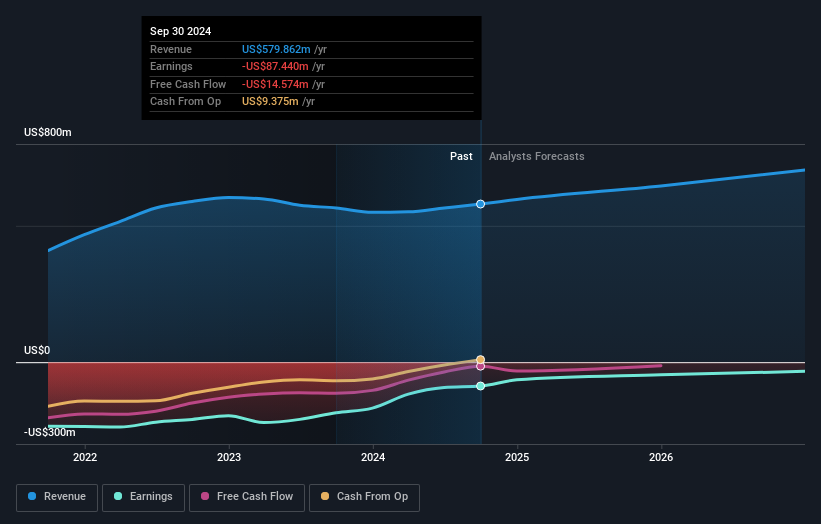

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling RealReal stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that RealReal shareholders have received a total shareholder return of 127% over the last year. That certainly beats the loss of about 12% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand RealReal better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with RealReal (including 1 which is significant) .

We will like RealReal better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.