Ryerson Holding Corporation (NYSE:RYI) shares have continued their recent momentum with a 28% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.5% over the last year.

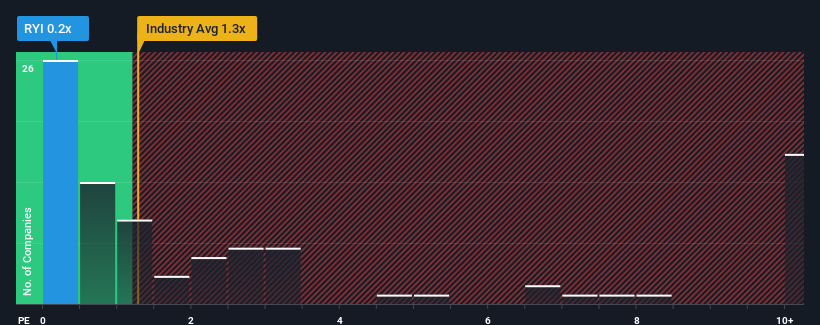

Although its price has surged higher, Ryerson Holding may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Metals and Mining industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Ryerson Holding's P/S Mean For Shareholders?

Ryerson Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ryerson Holding.Is There Any Revenue Growth Forecasted For Ryerson Holding?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ryerson Holding's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ryerson Holding's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. This means it has also seen a slide in revenue over the longer-term as revenue is down 5.8% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 0.6% over the next year. With the industry predicted to deliver 20% growth, that's a disappointing outcome.

With this information, we are not surprised that Ryerson Holding is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Despite Ryerson Holding's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Ryerson Holding's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Ryerson Holding's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Ryerson Holding (of which 1 doesn't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Ryerson Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.