The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Mativ Holdings Inc (NYSE:MATV)

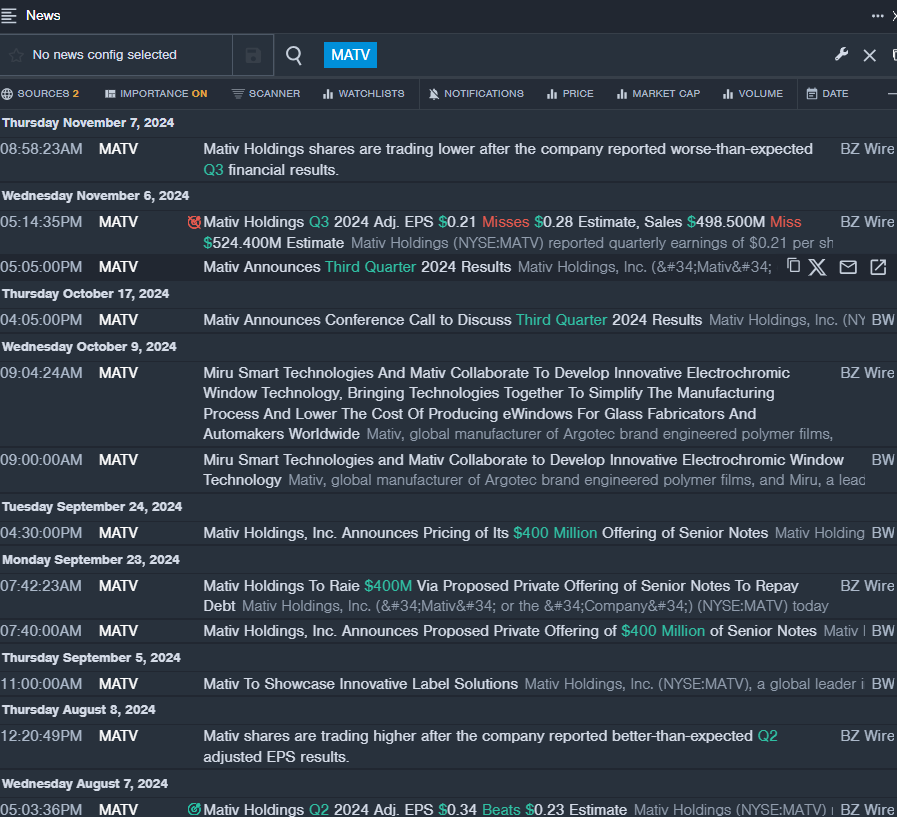

- On Nov. 6, Mativ Holdings reported worse-than-expected third-quarter financial results. Chief Executive Officer Julie Schertell commented, "We saw meaningful increases in volume and profitability in Filtration and our overall SAS segment during the third quarter, with SAS segment adjusted EBITDA increasing almost 20% year over year. This was somewhat offset by results in Advanced Films, which were impacted by automotive and construction end markets." The company's stock fell around 12% over the past five days and has a 52-week low of $10.78.

- RSI Value: 22.81

- MATV Price Action: Shares of Mativ dipped 21.1% to close at $13.73 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest MATV news.

Celanese Corporation (NYSE:CE)

- On Nov, 4, Celanese reported worse-than-expected third-quarter financial results and announced it intends to temporarily reduce its quarterly dividend. "In the third quarter, we faced a severely constrained demand environment that, in some cases like auto, degraded swiftly. I want to thank our teams for executing our value enhancing initiatives that are delivering improvements today while also laying the foundation for future growth," said Lori Ryerkerk, chair and chief executive officer. The company's stock fell around 29% over the past five days and has a 52-week low of $89.12.

- RSI Value: 14.38

- CE Price Action: Shares of Celanese fell 2.9% to close at $89.72 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in CE stock.

Ashland Inc (NYSE:ASH)

- On Nov. 6, Ashland reported worse-than-expected fourth-quarter financial results and issued FY25 revenue guidance below estimates. "Customer demand was generally consistent with our expectations in the fourth quarter and all business units delivered organic sales volume growth," said Guillermo Novo, chair and chief executive officer, Ashland. The company's stock fell around 5% over the past five days and has a 52-week low of $71.55.

- RSI Value: 25.90

- ASH Price Action: Shares of Ashland fell 7.6% to close at $80.70 on Thursday.

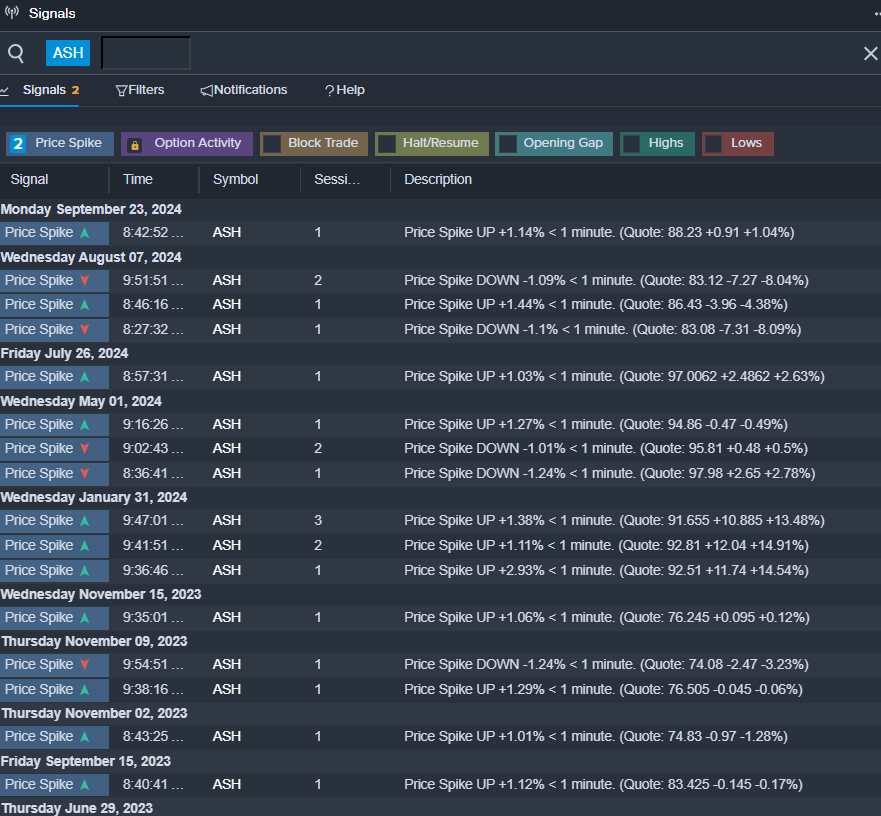

- Benzinga Pro's signals feature notified of a potential breakout in ASH shares.

Read This Next:

Read This Next:

- How To Earn $500 A Month From Nvidia Stock After Trump Win