Zhengzhou Coal Industry & Electric Power Co., Ltd. (SHSE:600121) shares have continued their recent momentum with a 41% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 8.4% isn't as impressive.

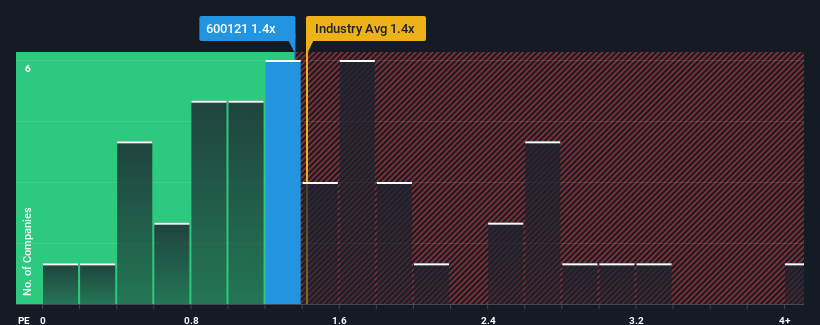

Even after such a large jump in price, there still wouldn't be many who think Zhengzhou Coal Industry & Electric Power's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when it essentially matches the median P/S in China's Oil and Gas industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Zhengzhou Coal Industry & Electric Power Has Been Performing

We'd have to say that with no tangible growth over the last year, Zhengzhou Coal Industry & Electric Power's revenue has been unimpressive. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Although there are no analyst estimates available for Zhengzhou Coal Industry & Electric Power, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Zhengzhou Coal Industry & Electric Power's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Zhengzhou Coal Industry & Electric Power's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Comparing that to the industry, which is only predicted to deliver 7.2% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Zhengzhou Coal Industry & Electric Power is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Zhengzhou Coal Industry & Electric Power's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Zhengzhou Coal Industry & Electric Power's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Zhengzhou Coal Industry & Electric Power with six simple checks on some of these key factors.

If you're unsure about the strength of Zhengzhou Coal Industry & Electric Power's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.