Despite an already strong run, Wintime Energy Group Co.,Ltd. (SHSE:600157) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

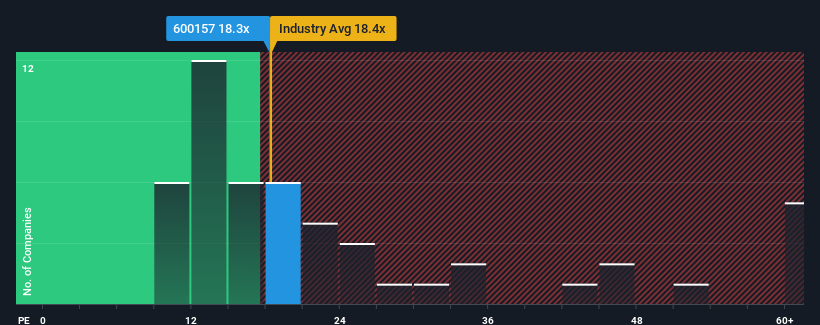

Even after such a large jump in price, Wintime Energy GroupLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.3x, since almost half of all companies in China have P/E ratios greater than 37x and even P/E's higher than 73x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Wintime Energy GroupLtd has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

How Is Wintime Energy GroupLtd's Growth Trending?

In order to justify its P/E ratio, Wintime Energy GroupLtd would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Wintime Energy GroupLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a decent 5.9% gain to the company's bottom line. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 58% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 8.9% as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

With this information, we can see why Wintime Energy GroupLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Wintime Energy GroupLtd's P/E?

Wintime Energy GroupLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Wintime Energy GroupLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Wintime Energy GroupLtd with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.