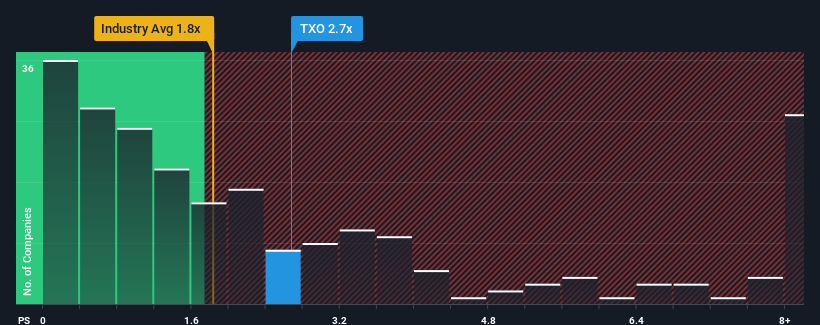

When close to half the companies in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") below 1.8x, you may consider TXO Partners, L.P. (NYSE:TXO) as a stock to potentially avoid with its 2.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How TXO Partners Has Been Performing

Recent times haven't been great for TXO Partners as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on TXO Partners will help you uncover what's on the horizon.How Is TXO Partners' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as TXO Partners' is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 25% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 25% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the one analyst following the company. With the industry predicted to deliver 76% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that TXO Partners' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On TXO Partners' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that TXO Partners currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 3 warning signs for TXO Partners you should be aware of, and 1 of them is a bit concerning.

If you're unsure about the strength of TXO Partners' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.