It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Luxshare Precision Industry (SZSE:002475). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is Luxshare Precision Industry Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Luxshare Precision Industry has grown EPS by 19% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

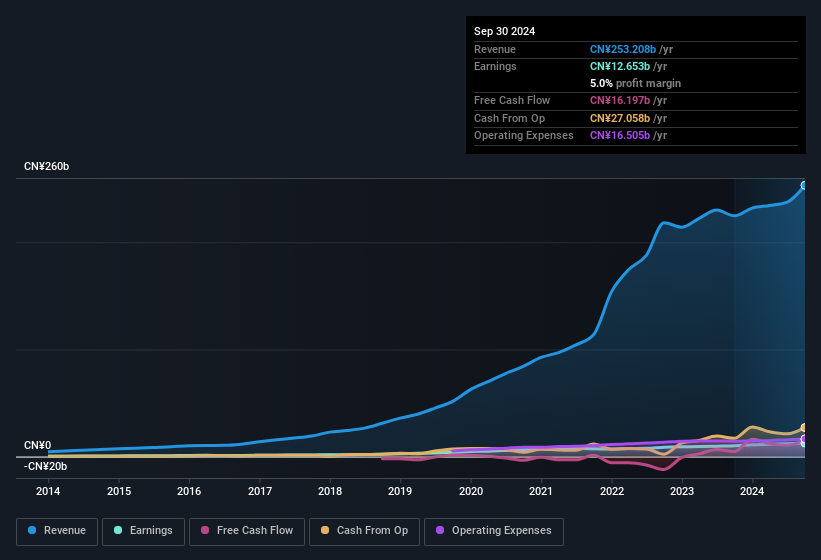

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Luxshare Precision Industry achieved similar EBIT margins to last year, revenue grew by a solid 13% to CN¥253b. That's a real positive.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Luxshare Precision Industry achieved similar EBIT margins to last year, revenue grew by a solid 13% to CN¥253b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Luxshare Precision Industry's forecast profits?

Are Luxshare Precision Industry Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a CN¥294b company like Luxshare Precision Industry. But we are reassured by the fact they have invested in the company. We note that their impressive stake in the company is worth CN¥845m. While that is a lot of skin in the game, we note this holding only totals to 0.3% of the business, which is a result of the company being so large. This still shows shareholders there is a degree of alignment between management and themselves.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations over CN¥58b, like Luxshare Precision Industry, the median CEO pay is around CN¥2.7m.

Luxshare Precision Industry's CEO took home a total compensation package worth CN¥2.0m in the year leading up to December 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Luxshare Precision Industry Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Luxshare Precision Industry's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Everyone has their own preferences when it comes to investing but it definitely makes Luxshare Precision Industry look rather interesting indeed. Now, you could try to make up your mind on Luxshare Precision Industry by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.