GuangDong PaiSheng Intelligent Technology Co.,Ltd (SZSE:300176) shares have continued their recent momentum with a 44% gain in the last month alone. Looking further back, the 25% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

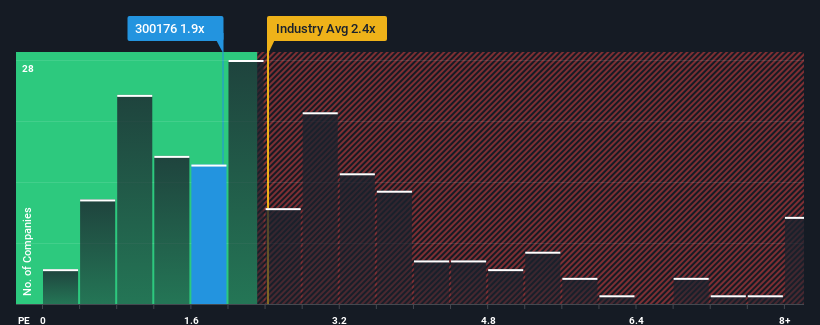

Although its price has surged higher, there still wouldn't be many who think GuangDong PaiSheng Intelligent TechnologyLtd's price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S in China's Auto Components industry is similar at about 2.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has GuangDong PaiSheng Intelligent TechnologyLtd Performed Recently?

The recent revenue growth at GuangDong PaiSheng Intelligent TechnologyLtd would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on GuangDong PaiSheng Intelligent TechnologyLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like GuangDong PaiSheng Intelligent TechnologyLtd's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like GuangDong PaiSheng Intelligent TechnologyLtd's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.3% last year. This was backed up an excellent period prior to see revenue up by 41% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that GuangDong PaiSheng Intelligent TechnologyLtd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On GuangDong PaiSheng Intelligent TechnologyLtd's P/S

GuangDong PaiSheng Intelligent TechnologyLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of GuangDong PaiSheng Intelligent TechnologyLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You need to take note of risks, for example - GuangDong PaiSheng Intelligent TechnologyLtd has 2 warning signs (and 1 which is significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.